CIOS Aggregation Engine

Christian Paulus / November 1, 2019

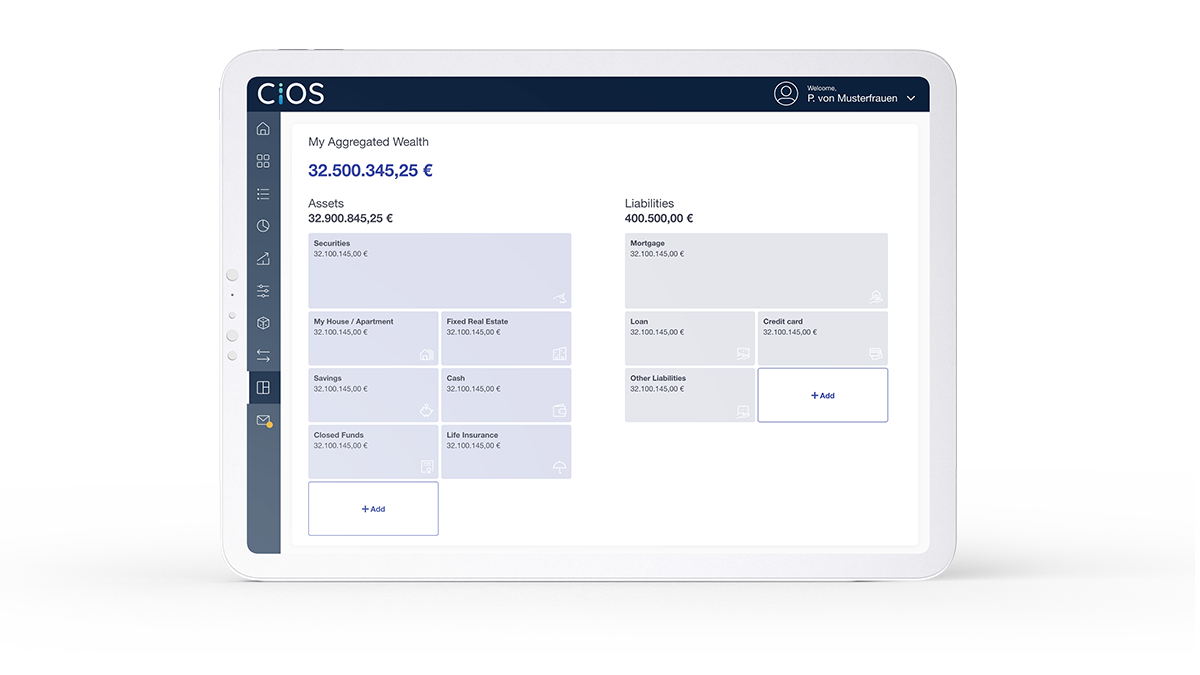

The Aggregation Engine is our insights tool for multi banking, PSD II, financial aggregation and open banking

Aggregation is the beginning of the digital investment advice of the future. While financial aggregation helps the customer to stay on track with his or her finances, it supports the bank to improve customer interaction.

But aggregation also bears analytical potential for a digital investment journey: A 360° view can be the starting point for a portfolio analysis or a calculation of retirement gaps. Using financial aggregation, the bank can identify what is the individual next-best action for each of its customers.

Learn more about our Aggregation Engine for multi banking:

Get a 360° view on the wealth of your customer.

Check the portfolio of your clients at another bank and identify the optimization potential

Generate sales impulses with the knowledge about your customer

Building a 360° view on the customer requires a complete set of data

In order to provide you with a holistic view of all your clients’ assets we offer different possibilities for data gathering.

- Cash Accounts

Cash Accounts via Rest API through our global partner network - Portfolio Accounts

Portfolio Accounts via Rest API through our global partner network - Financial Market

Financial Market Data Provider through modern Rest APIs - Real Estate Data

Real Estate matching a manual entry of an address with the evaluation engine of our partners - Private Equity

Private Equity as approximative values via several market data providers - Cars and Art

Cars and Art via Rest API of several pricing data bases - Pension Accounts

Pension Accounts – for now just manually, via OCR or as proxy from the cash account - Insurance Data

Insurance Data – for now just manually, via OCR or as proxy from the cash account

Insights generated from a 360° view:

- Cash accounts for identifying income and expense structures of the customers, which bears insights into savings potentials and risk-bearing capacities

- Portfolio accounts for analyzing the current investment structure

- Market data to gather insights into the portfolio based on current financial market data

- Real estate based on manual entry of a few data points with automated evaluation via real estate market data providers

We connect to several companies and partners

- Financial market data: Refinitiv, Morningstar, FactSet, Sustainalytics

- Frontend & middleware partners: Backbase, Five Degrees

- Asset data provider: Sprengnetter

- Core banking & portfolio management: Sopra Banking, Temenos

”With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.”

Ronald Tuinenga, Product Owner Digital Investments ABN AMRO