CIOS Analytical Engine

Christian Paulus / November 1, 2019

The Analytical Engine is our tool for building a portfolio health check, MiFID II reporting, or other analysis such as stress testing or customer insight

Our Analytical Engine is the foundation for generating financial information, next-best actions for the client and sales impulses to the consultant or sales manager.

Our software therefore includes a variety of algorithms to examine the financial situation and portfolio of retail, residential and institutional clients. Within our modular architecture, banks, asset managers and insurance companies can easily add algorithms to their own set of rules.

Benefits of our Analytical Engine:

Get a wide range of analytical techniques and analyses.

We provide you a MiFID II compliant on-boarding process.

Our best-in-class analytics software comes with numerous features

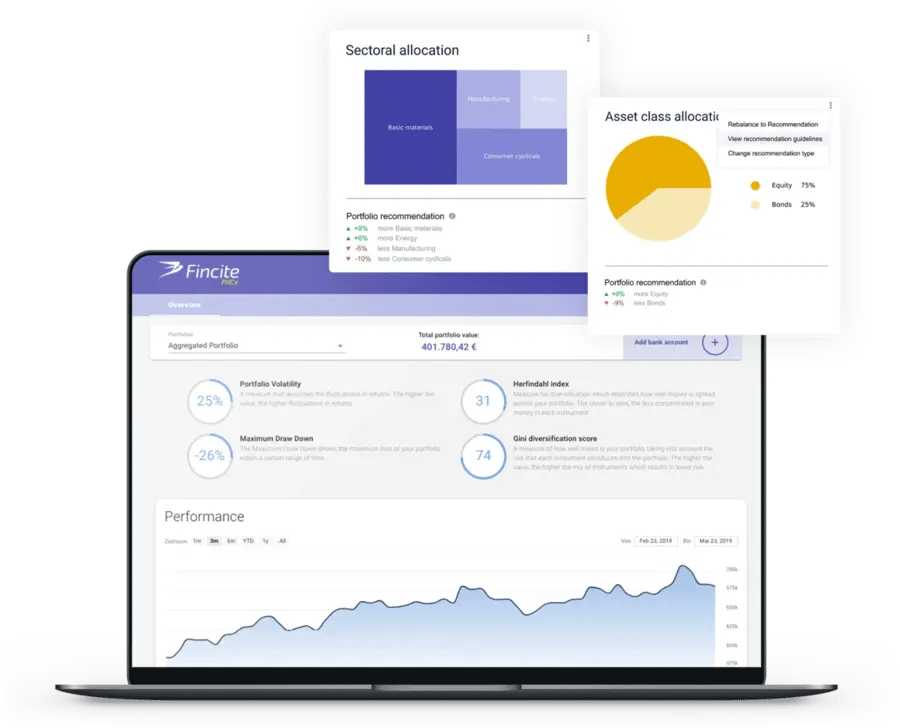

Portfolio Analysis

- Portfolio allocation (including fund look-through)

- Portfolio performance and indicators (e.g. Alpha, Beta, Sharpe ratio, tracking error)

- Portfolio risks (e.g. volatility, Maximum Drawdown, Value at Risk, Conditional Value at Risk)

- Portfolio optimizations (e.g. Mean-Variance, Risk Parity, Black-Littermann, Model Portfolio)

- Performance attributions

- Benchmarking

- Stress testing

- Efficient frontier

- Diversification measures (regional, sectoral, company size) (Diversification ratio, Herfindahl-Hirschman Index, Gini coefficient, dispersion)

- Sustainability scoring

Personal financial analysis

- MiFID II compliant client on-boarding: Risk-bearing capacity, knowledge and experience, financial situation

- Savings potentials

- Retirement gaps

- Savings planning

- Withdrawal planning

- Financial performance

All the techniques are applied to find the individual next-best action for the customer, advisor, or sales department of our clients.

Delivery models

The Analytical Engine can be used in different ways:

- API

Connect to our API and receive the analytics - Reporting

Predefined reports like MiFID II reporting, relevant loss report - IFTTT Engine

Build your own rules on top of our data model - Chart library

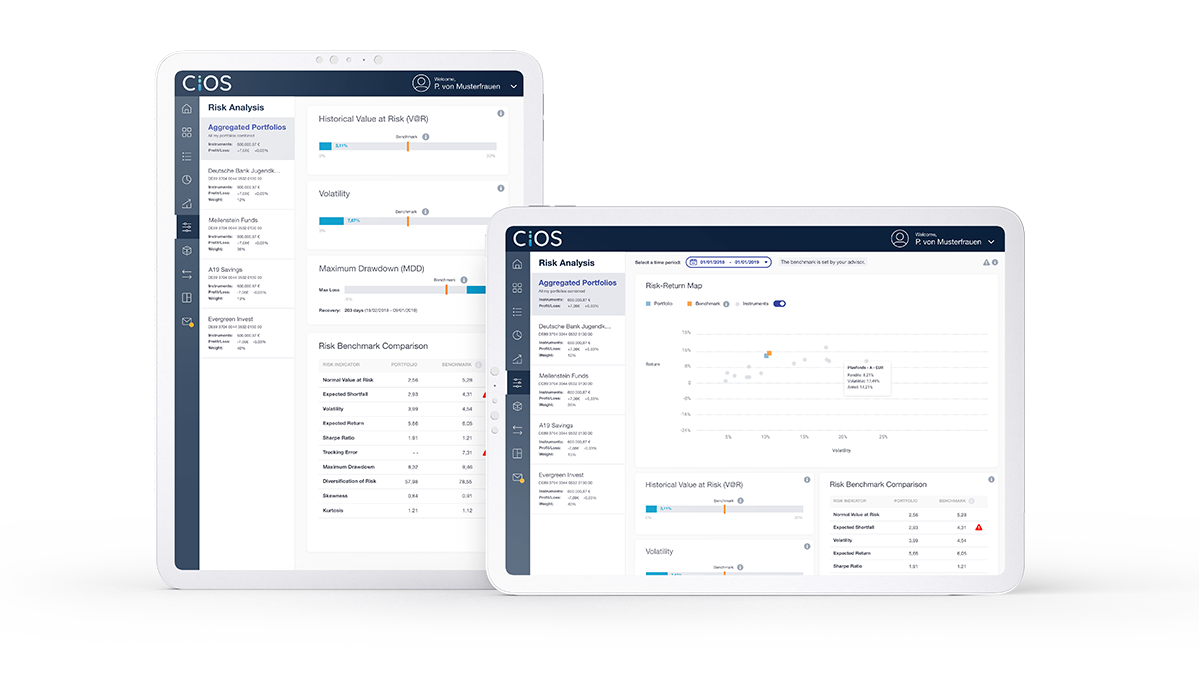

Receive prepared charts - CIOS Dashboard

Dashboard for Advisors and Customer

”With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.”

Ronald Tuinenga, Product Owner Digital Investments ABN AMRO