Portfolio Optimization

for end customers (B2C) and institutional customers.

Our Software Solutions for your Customer Onboarding as Self Execution, Advisor Guided or Hybrid!

Whether 100% digital or hybrid with personal advice, our software adapts to your operating model in a modular way.

From SAA Construction, Advisor Software to Portfolio Management. Our software digitizes your process E2E.

Transaction Ordering. Contact us for more information.

From asset aggregation to portfolio analysis with CIOS.Reporting you get all your clients' asset data - prepared in intuitive dashboards.

In this case study, we show you how we built the digital bridge for intelligent investment advisory between BCA´s brokers and clients based on our modular software Fincite.CIOS.

The BCA Group is an established player in the German intermediary financial services business. As a full-service provider for independent intermediaries, multiple agents and tied agents, BCA, BCA VVS and Bank für Vermögen provide a comprehensive offering and settlement infrastructure for insurance and investment business, as well as various digital interfaces to the customer.

BCA's vision was to offer its customers and advisors the best digital investment experience in the financial services sector. This vision was the trigger for our collaboration. The challenge was to create a digital and intuitive investment platform that meets all of BCA's requirements, from onboarding to reporting.

Considering BCA's vision Fincite implemented a multi-module platform, which was seamlessly integrated into BCA’s existing software, DIVA. The new investment platform allows BCA brokers to digitally manage their entire financial advice journey. Now, brokers and clients are provided with holistic portfolio insights and ad-hoc, single, and series reports. The platform also allows the integration of various custodian banks and includes:

The new digital platform offers a holistic financial analysis for freelance brokers and helps them to intensify their customer relationships. In addition, the software allows for extensive investment analysis to be created for both advisors and their clients. The new reporting includes:

With our Software Fincite.CIOS, BCA does now fully fulfill the regulation on sustainability-related disclosure in the financial services sector. BCA investment advisors and wealth managers will guide the customer through an ESG-compliant onboarding and will be able to create investment proposals based on environmental, social, and governance criteria that really meet the sustainable criteria of their customers. The ESG feature will:

for end customers (B2C) and institutional customers.

Python, Django, React

Investment analysis and reporting, performance, profit and loss and risk calculation, portfolio data processing.

Our Promise:

Get the Case Study directly into your email box.

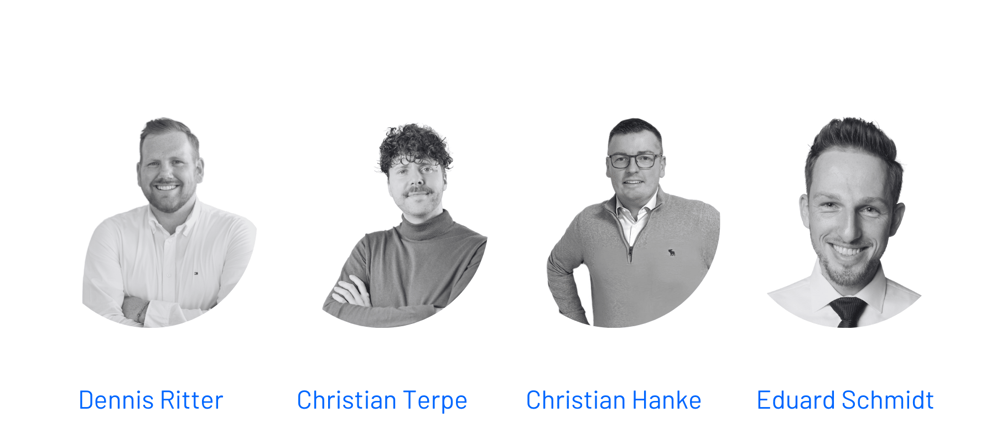

Discuss your digitization project with our experts. Whether it's customer onboarding, digital or hybrid consultation, ESG or investment reporting.

Personal demo on request.

.png?width=972&height=486&name=Awards%20Website%20(1).png)