Easily integrated into your IT landscape

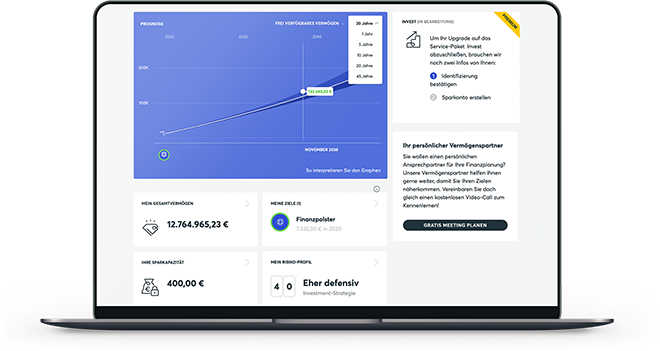

Hybrid Robo Advisor:

Automated portfolio management with human interaction

“Human-only” offline advice is not scalable and requires considerable manual effort. On top of that, increasing regulatory requirements lead to liability and reputational risks.

Fincite Hybrid Robo Advisor enables our clients to overcome these challenges. Advise your clients automated & individually and empower your advisor!

Benefits of our Hybrid Robo Advisor:

Fast to market as stand-alone or fully integrated within < 3 months

Customer oriented, beats portfolio orientation.

Start with a digital or hybrid onboarding process

Our Hybrid Robo Advisor’s digital onboarding process includes profiling, setting objectives and determining portfolio options.

Step 1:

Profiling (MiFID II)

Step 2:

Objectives and restrictions

Step 3:

Portfolio construction

1. Profiling (MiFID II)

To model the customer, CIOS contains a dynamic workflow. The bank can build its own workflow to identify the customer profile. The client risk score is derived from the onboarding risk questionnaire, covering the following topics:

- Knowledge and experience

- Financial situation including loss-bearing capacity

- Investment goals and strategies

2. Objectives and restrictions

CIOS contains a vast set of goals and restriction settings, for example goals for retail customers such as capital goals, saving plans, consumption or passive income and retirement goals.

For private banking and institutional customers, there are further goals regarding sustaining of wealth, risk bandwidth or expected returns with risk budgets. The customer can, upon demand, also set the restrictions from our Optimization Engine.

3. Portfolio construction

Based on the bank’s model portfolio or its expected return and its product galaxy, our software matches the MiFiD II risk profile, objectives and restrictions of the customer towards a suggested portfolio. Within the portfolio construction our software manages:

- Model portfolio

- Suitability check

- Matching customer risk profile to model portfolio

- Rebalancing of portfolio

Download our Hybrid Robo Advisor presentation and discover how we can support your digital investment service!

Feedback from our clients:

With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.

The collaboration with Fincite will enables us to make our investment research services directly available to our partners, especially from the perspective of Bank für Vermögen AG, in client advisory services, but also in individual portfolio construction.

Evergreen is aiming for technological leadership in digital financial planning and investing. Fincite’s CIOS is paving the way from our state- of-the-art asset management to a great customer experience.

Together with Fincite, we have created a new-generation financial analysis tool. Their innovative thinking combined with their strong focus on financial mathematics led to an impressively efficient tool for our clients.