The world’s first connected investment platform

Christian Paulus / November 1, 2019

In a world where “human financial advice” gets more expensive day by day, Fincite empowers retail banks, private banks and insurers to provide digital or digitally-empowered (hybrid) investment services to their clients.

All this seamlessly integrated into their current processes, channels and architectures via one software – Fincite.CIOS.

Our customers benefit from:

Increased revenue per customer, advisor and portfolio manager

Reduced costs through cutting efforts along the investment value chain

Ensured compliance through automated documentations and rules

Our investment platform empowers banks, insurers and asset managers to:

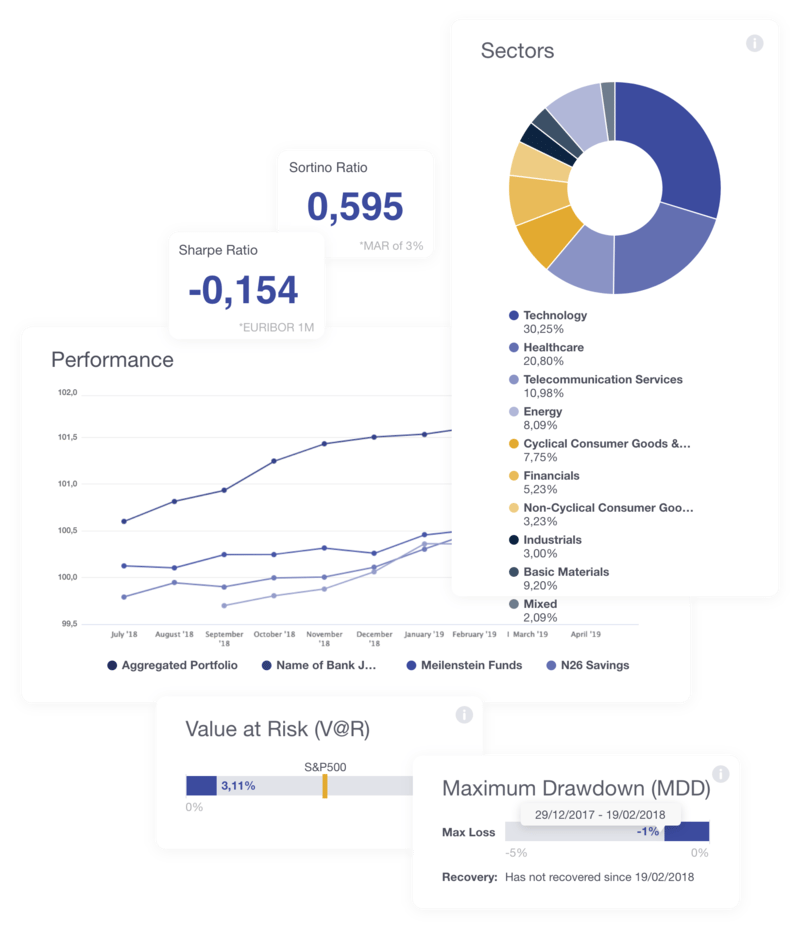

Provide holistic advice on all assets of a customer aggregated into a 360° view.

More information about the Aggregation Engine.

Generate insights for the customers by analyzing their financials and providing impulses for the advisor.

More information about the Analytical Engine.

Automate the construction of individual portfolios matching the preferences, objectives and restrictions of the customer with the investment rules of the bank.

More information about the Optimization Engine.

Our software supports the value chain of investments with a lot of functionalities bundled in the CIOS-Suite.

Our modular investment platform:

- Customer Channel

Customer Support/Dashboard, Wealth Aggregation, Digital Onboarding, Customer Management - Advice

MiFID II check & profiling, retirement planning, Hybrid advice, integrated research - Investment

Portfolio management & analysis, rebalancing, investment restrictions simulation - Servicing

Financial planning, private markets, 360° client view, alternative investments - Reporting

Client reporting, management reporting, performance reporting, risk reporting

Start small and be fast

Thanks to our modular setup, you can start by using single functionalities without implementation. Within only a few weeks, you can connect to our service via API or file transfer in order to explore our software’s features.

- Proof of Value

Test our application in your processes with your advisors, portfolio managers or test clients - Minimum Viable Product (MVP)

Implement CIOS for your individual use case within just a few months - Implementation

Depending on your architectural environment, we can integrate your Core Banking, CRM, Portfolio Management System or deposit bank

”With Fincite.CIOS, we can manage complex portfolios automatically. This strengthens the efficiency of our consultants and helps them focus on the essentials: the customer.”

Ronald Tuinenga, Product Owner Digital Investments ABN AMRO