CIOS Software: 3 features that revolutionise the advisory process

Nils Claassen

17 Dec 2025

At the end of the year, many look back, but we look forward. We have developed over 70 new features in CIOS for 2025 that will revolutionize the advisory process in 2026. Here are our highlights:

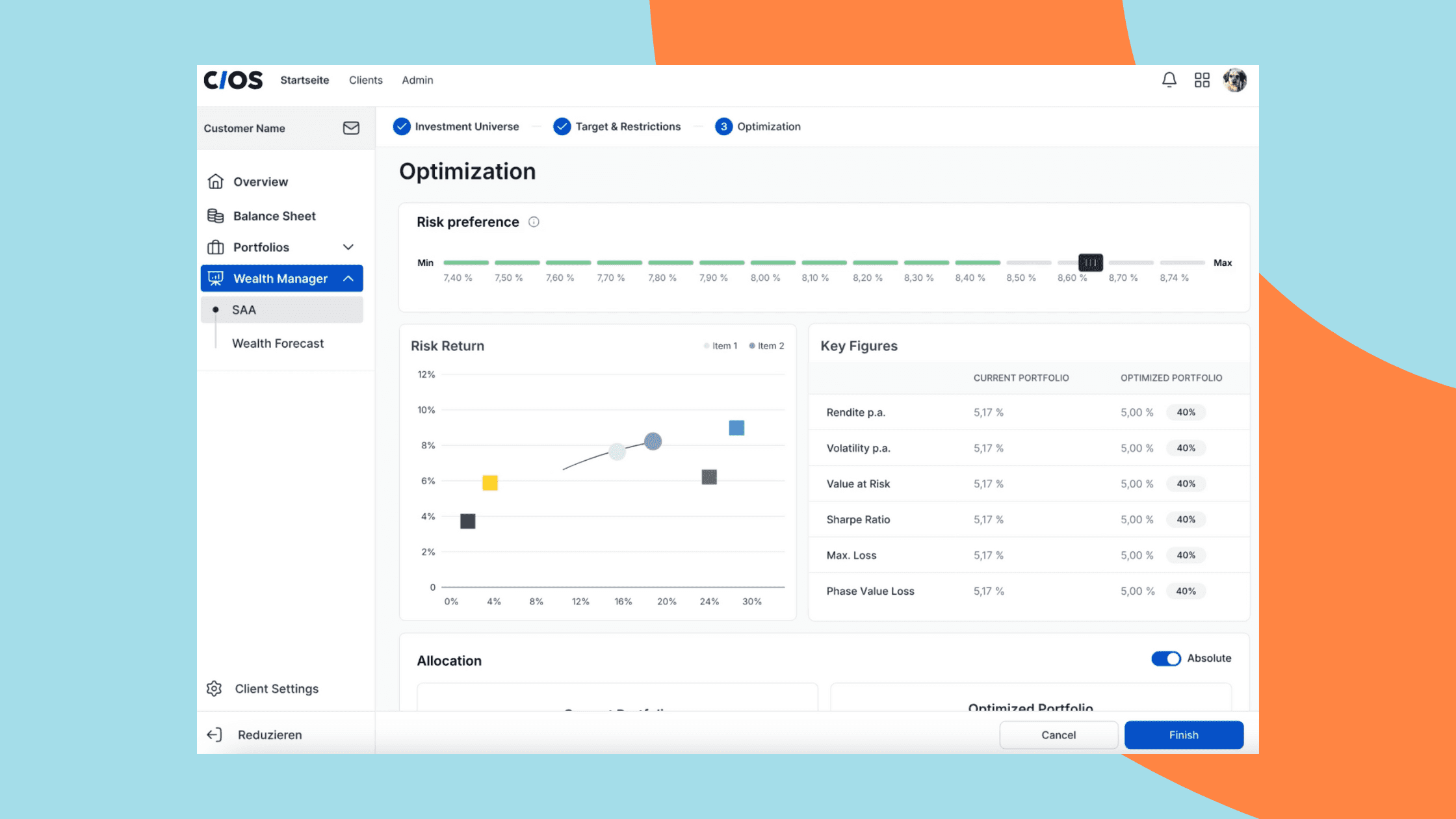

Strategic asset allocation: The ultimate time saver

Explaining portfolio adjustments has never been easier. In practice, it’s not the decision itself that takes the most time, but the clear explanation in conversation. Why is there a reallocation, what does that mean for risk, structure, and goal achievement, and how does it fit the investor profile?

This is precisely where Strategic Asset Allocation (SAA) comes in. It automatically optimises your clients' assets based on their profile, supported by smart financial algorithms. Instead of explaining long scenarios, a concrete, comprehensible optimisation of the asset structure emerges from the investor profile.

Current and optimised structures are directly compared visually. In seconds, a comprehensible, individual solution is created. This saves time, reduces lengthy explanations, and increases persuasiveness because the added value is instantly visible.

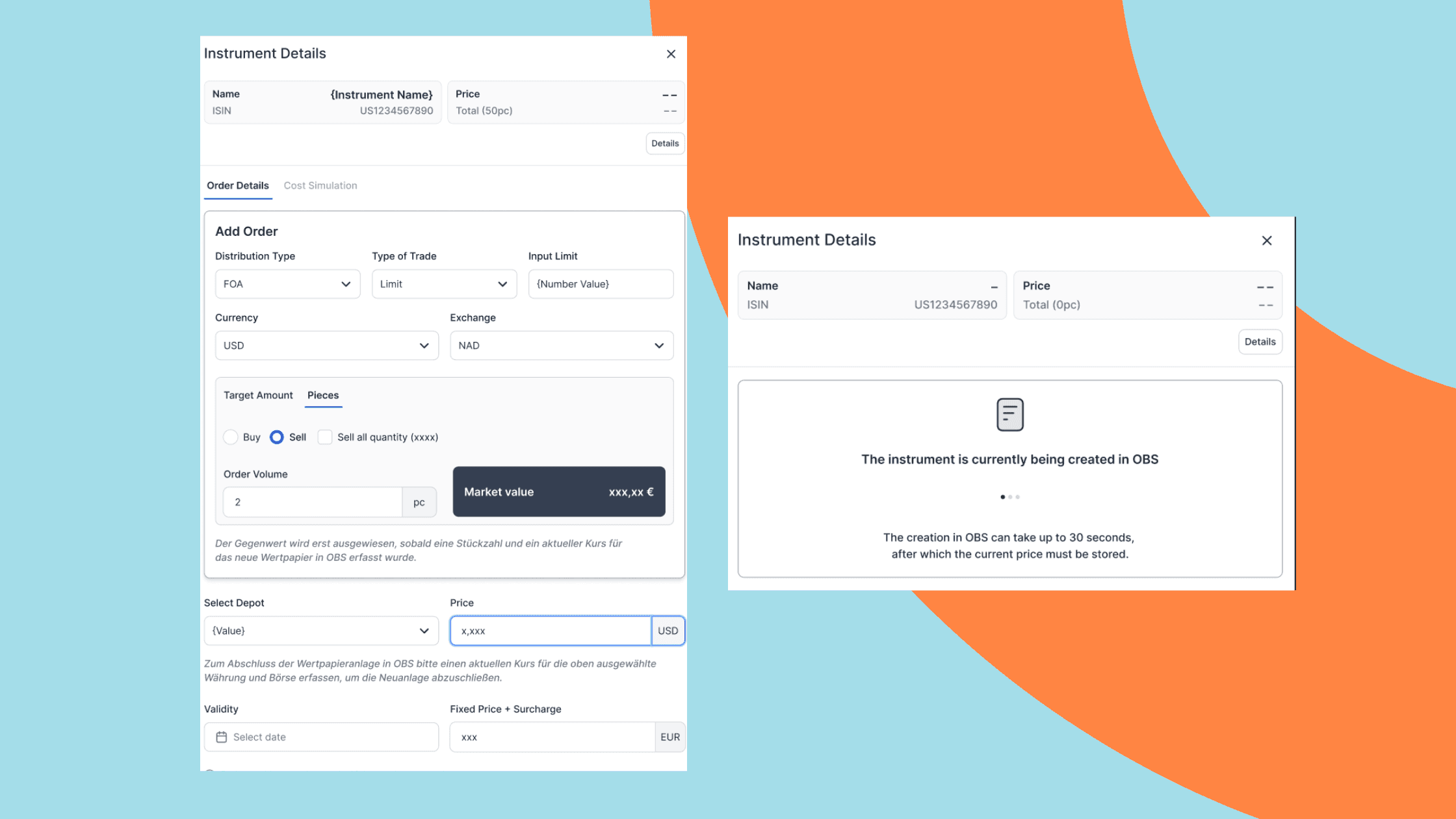

2. Ad hoc instrument creation: The self-execution hack

A product is not in the core banking system. Until now, that often meant a break: create a support ticket, submit information, wait, and the order hangs, even though the consulting process has already been completed.

With ad-hoc instrument creation, execution stays where it belongs, in the tool and in the process. The consultant initiates the creation directly in the tool, enters the price, and tracks the status live in the order flow.

No follow-up questions, no waiting loops, no dependency on ticket processes right in the execution.

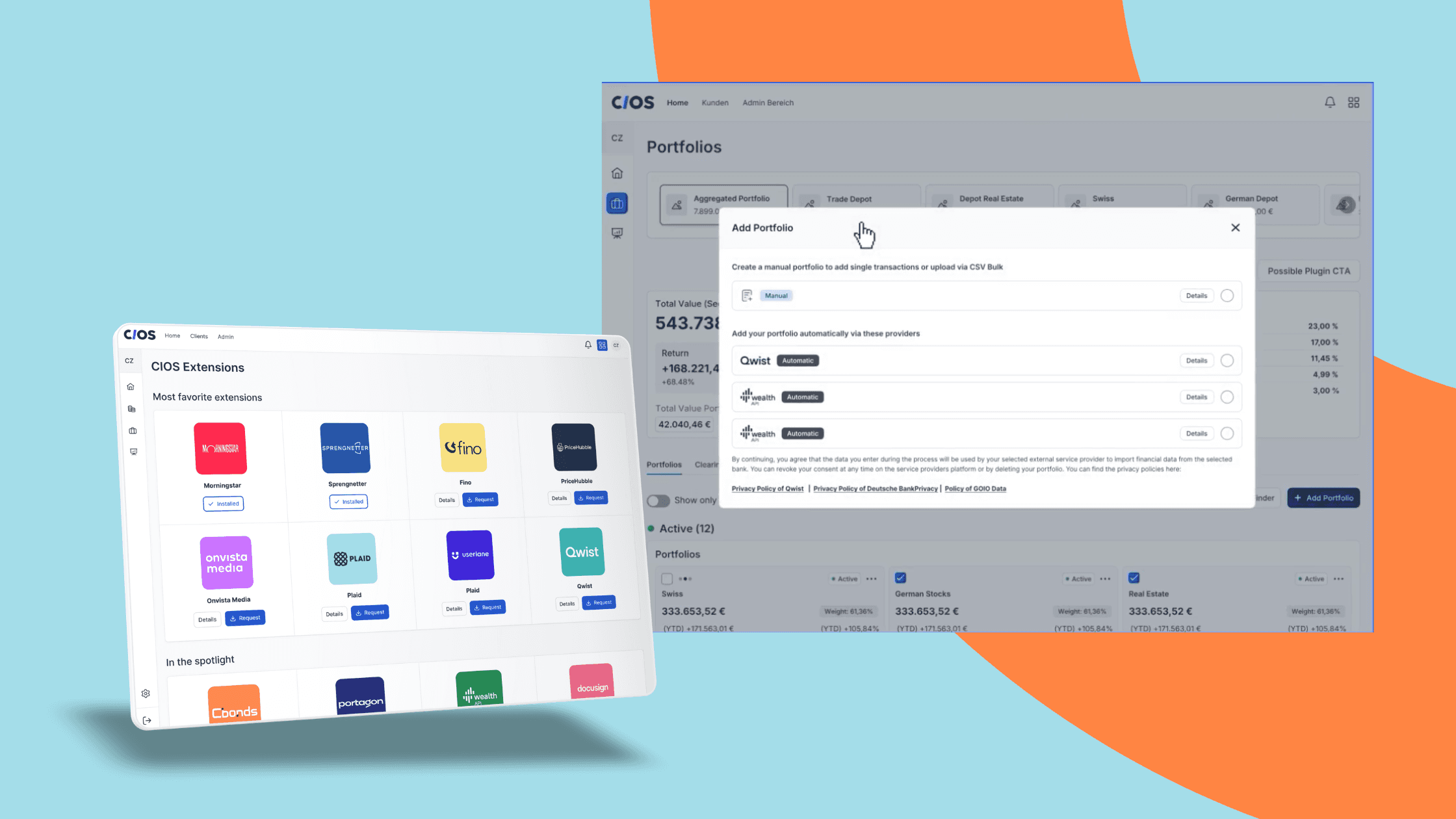

3. AISP integrations: The 360-degree wealth overview

When assets are spread across multiple banks, accounts, and depots, preparation quickly becomes a tedious task: searching for data, checking transactions, consolidating information. This costs time and makes achieving a clean, complete overview difficult.

CIOS can be seamlessly connected with partners like wealthAPI, Qwist, and fino. Through the CIOS Extension Store, external accounts and transactions can be aggregated directly in your view. Instead of opening multiple sources, everything is available in a single view.

This saves preparation and brings real added value: a complete, compliant 360-degree wealth overview at the push of a button.

The story is measurable impact

Our features speak for themselves, but the real story behind is the effect:

• AuV tripled

• 12 weeks of time savings per year per consultant

• 80% fewer breaches of investment restrictions