Product

Clients

About us

Knowledge Hub

Onboarding

Watch the Onboarding Tutorial

Product

Clients

About us

Knowledge Hub

Onboarding

Watch the Onboarding Tutorial

Product

Clients

About us

Knowledge Hub

Onboarding

Watch the Onboarding Tutorial

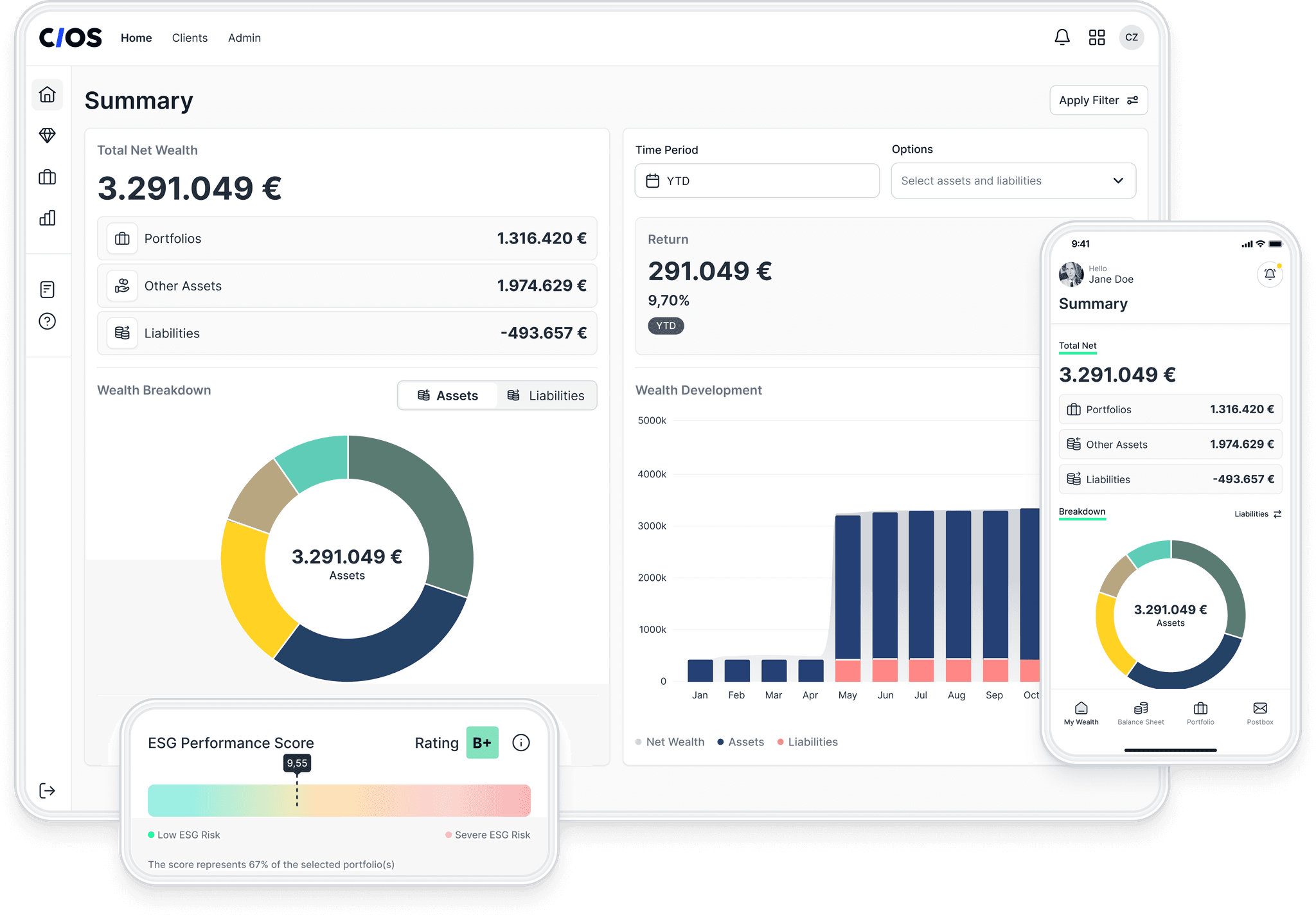

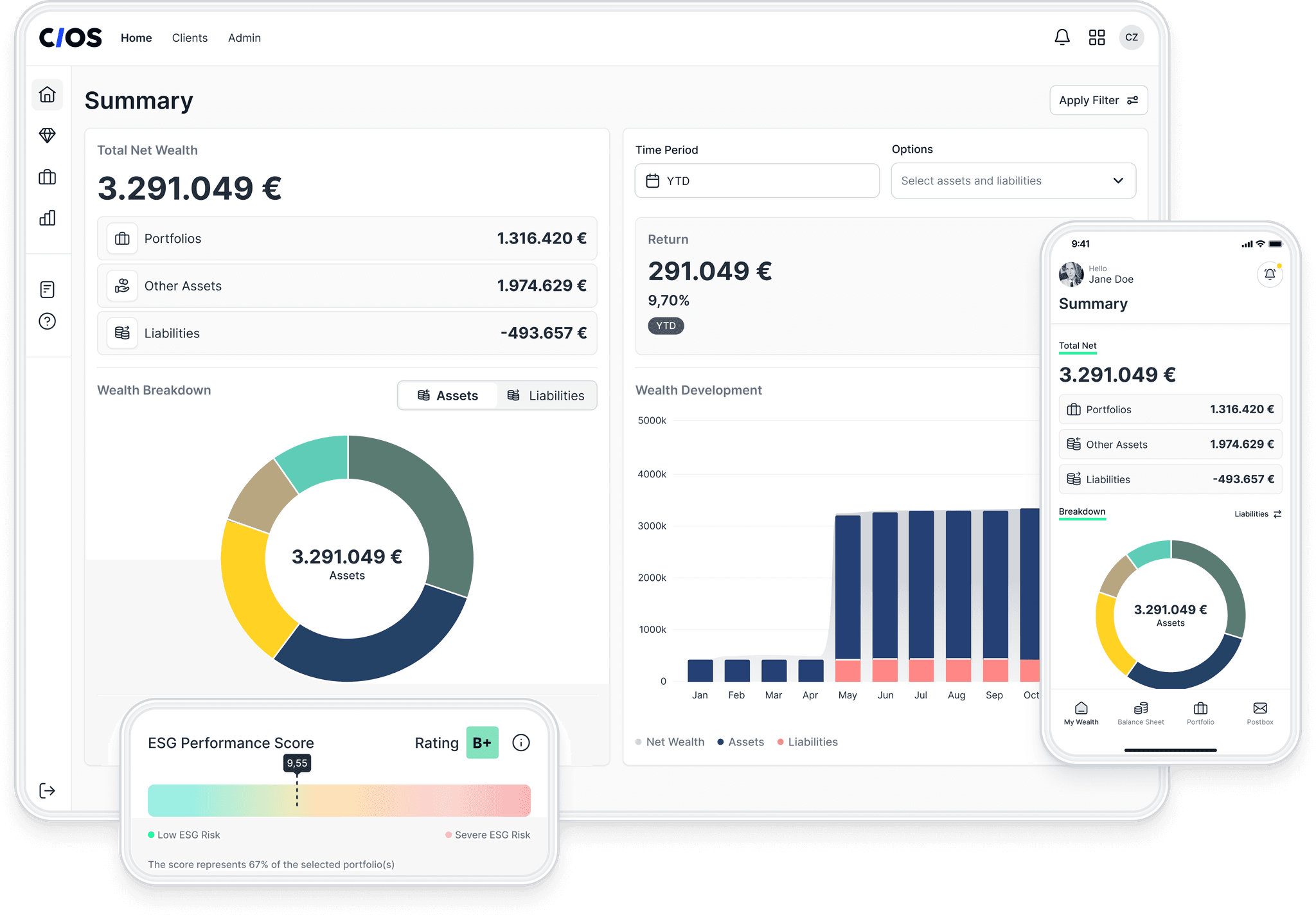

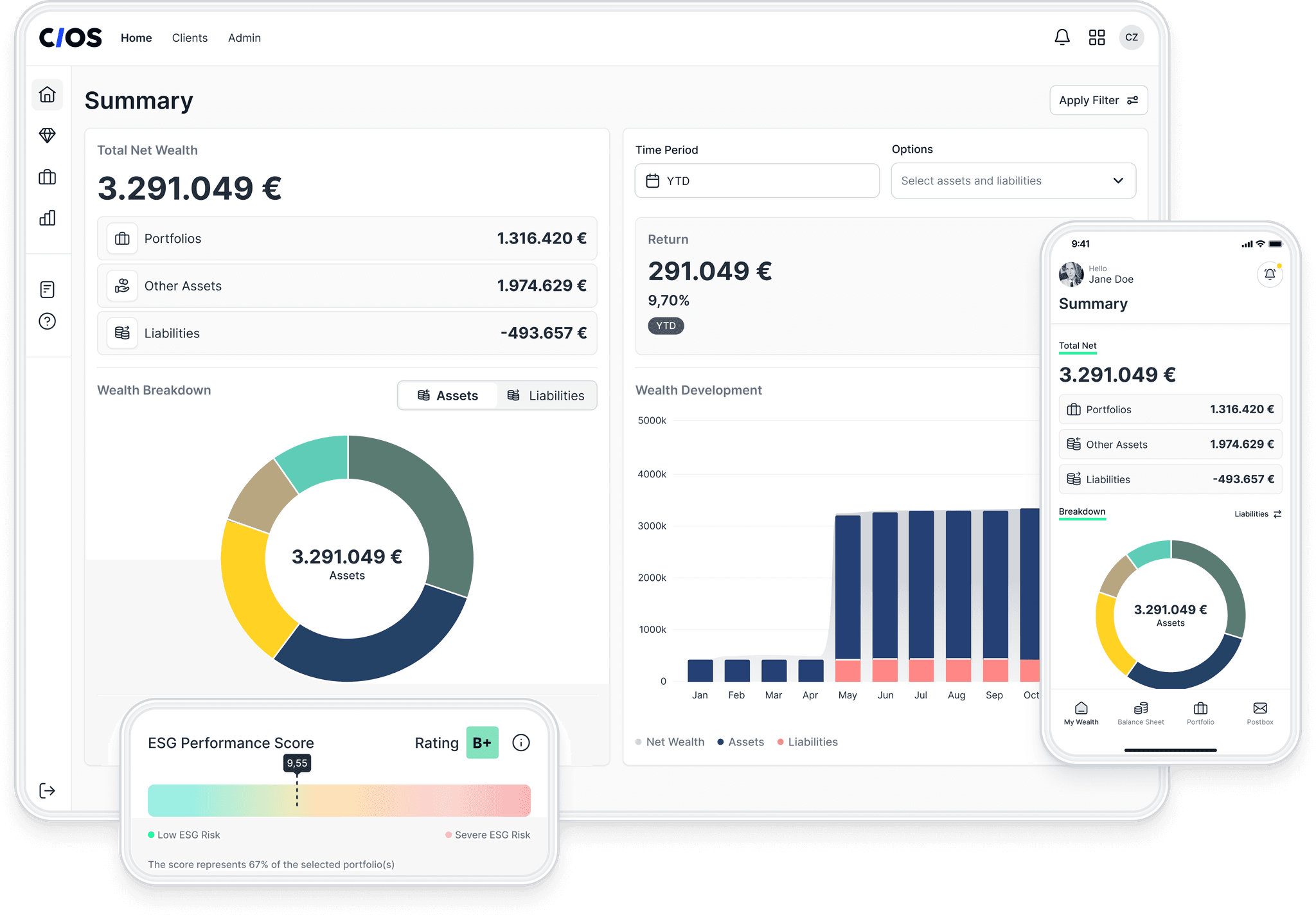

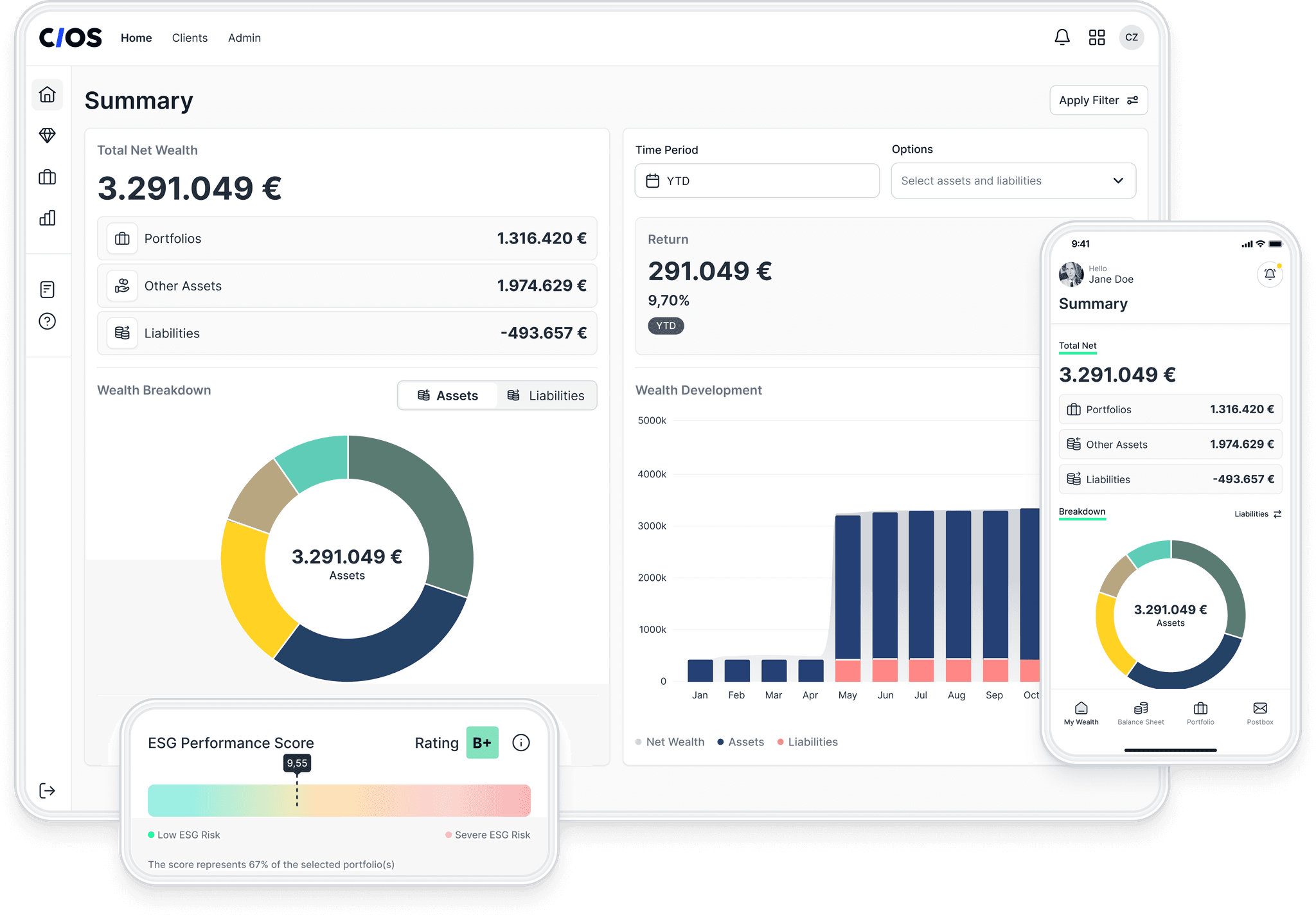

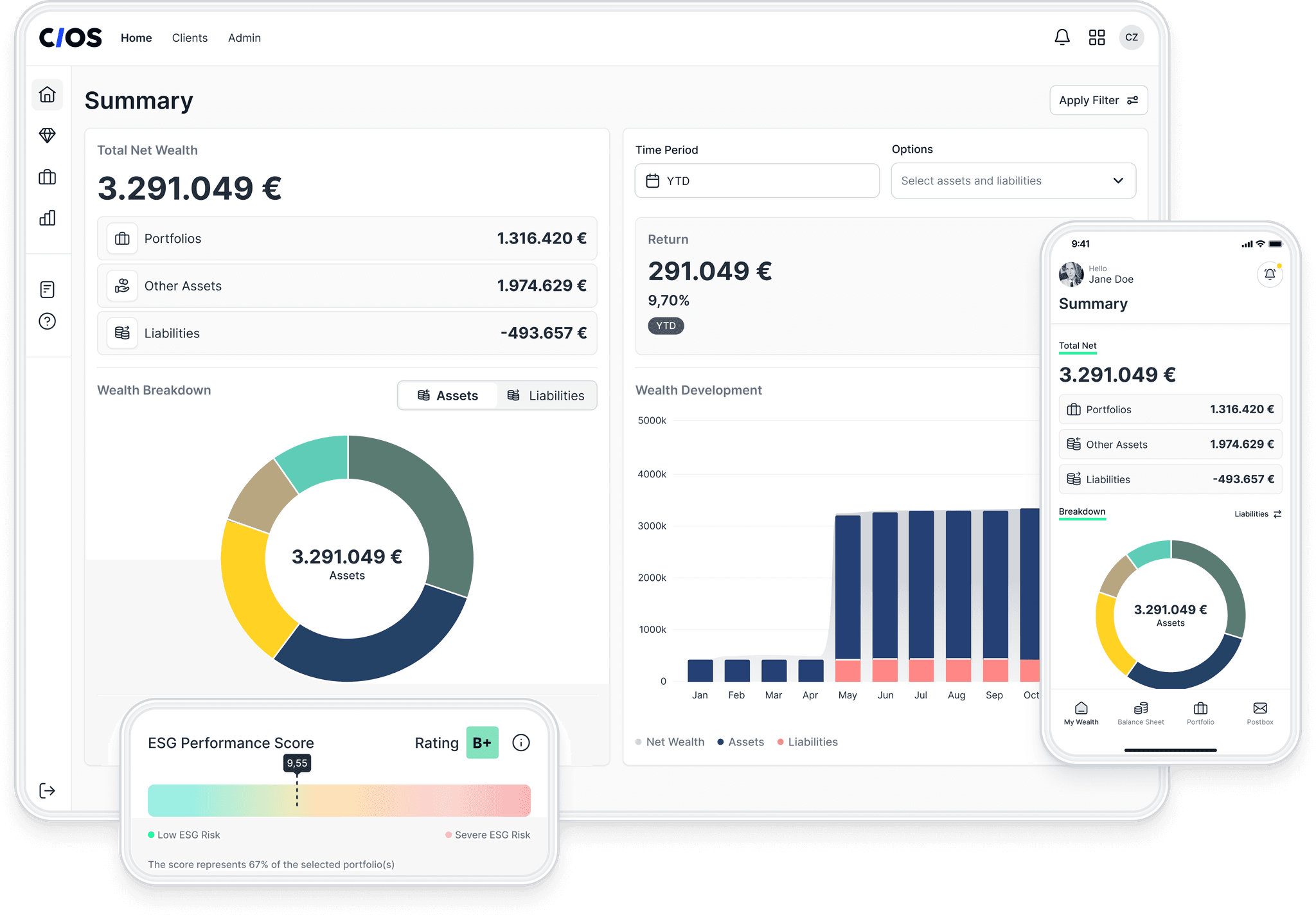

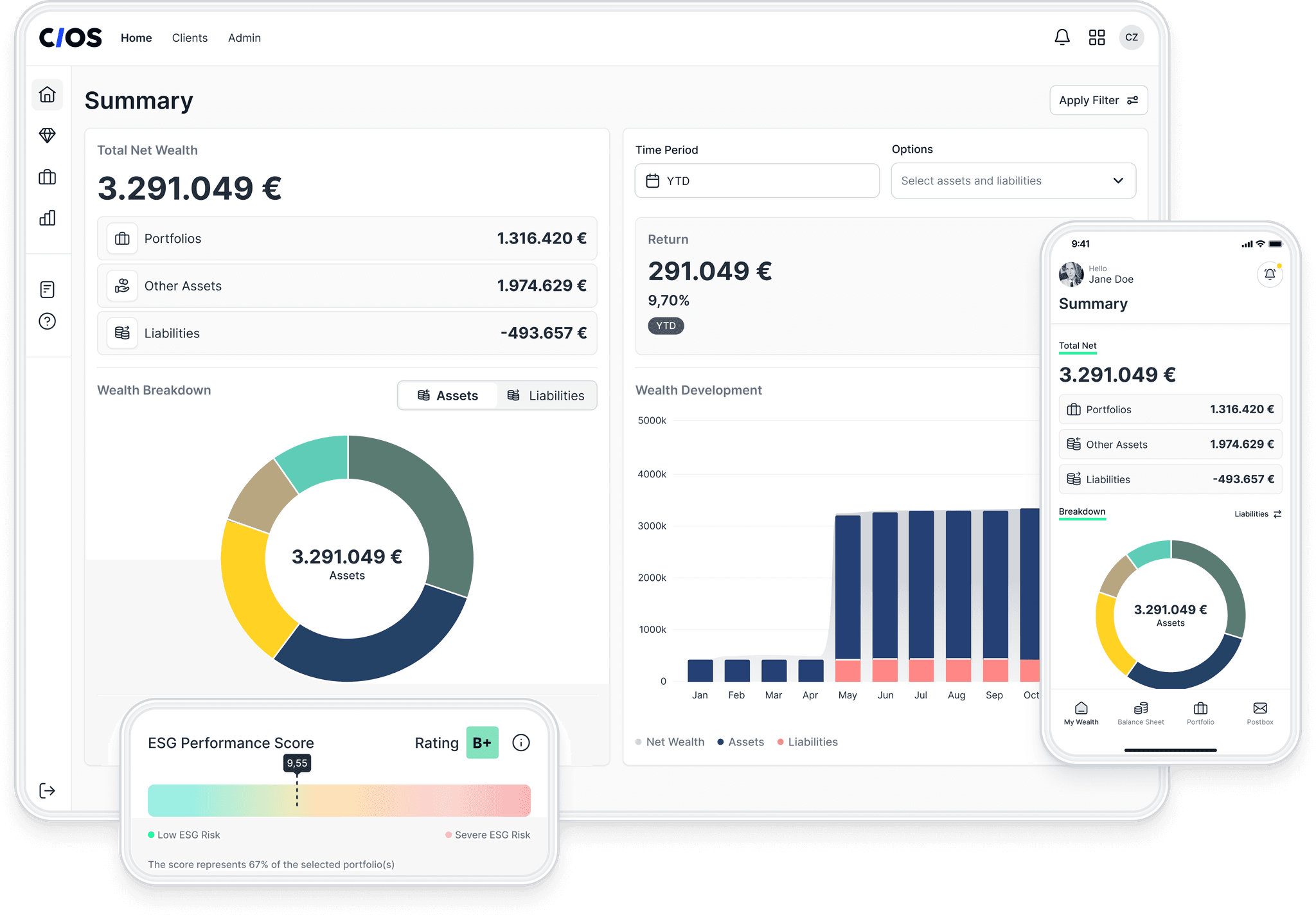

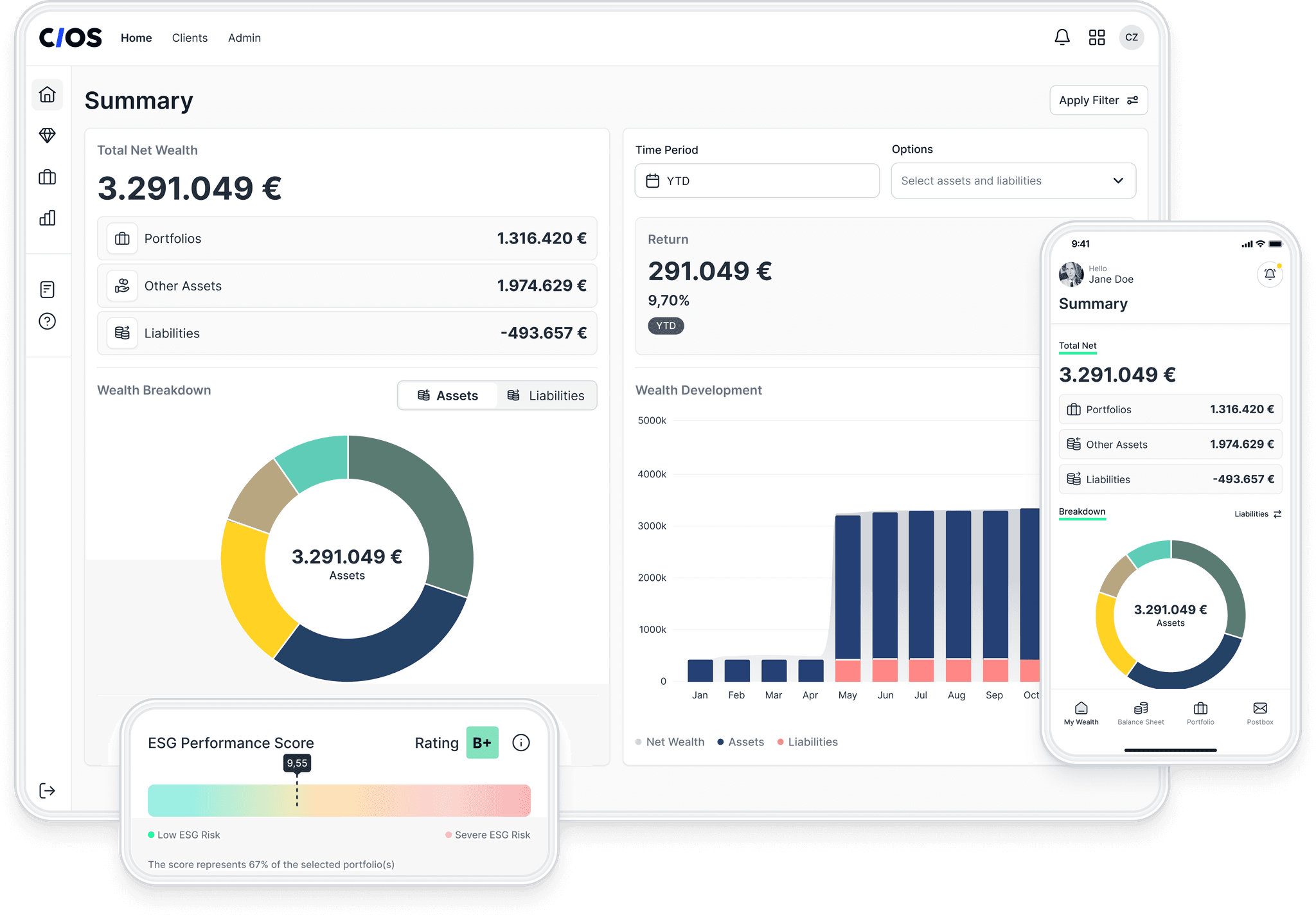

Holistic investment reporting

Holistic investment reporting

The reporting module of fincite • cios provides insights into

the customer's overall financial situation.

The reporting module of fincite • cios provides insights into

the customer's overall financial situation.

The reporting module of fincite • cios provides insights into the customer's overall financial situation.

The reporting module of

fincite • cios provides insights into the overall

financial situation of the customer.

The reporting module of fincite • cios provides insights into

the customer's overall financial situation.

Holistic wealth overview of the client

Holistic wealth overview of the client

Holistic Asset Overview

of the Client

Holistic wealth overview of the client

In-depth analyses and breakdowns

In-depth analyses and breakdowns

In-depth analyses and

breakdowns

In-depth analyses and breakdowns

Modern and dynamic UX

Modern and dynamic UX

Modern and intuitive UX

Modern and dynamic UX

Investment reporting: Ad-hoc & in real time

Investment reporting: Ad-hoc & in real time

Investment Reporting:

Ad-hoc & in Real-Time

Investment reporting: Ad-hoc & in real time

Enchant your advisors and clients with holistic investment reporting and gain more time for what matters: your clients.

Inspire your advisors and clients with holistic investment reporting

and gain more time for what matters: your clients.

Inspire your advisors and clients with holistic investment reporting and get more time for what matters:

Your clients.

Inspire your advisors and clients with holistic investment reporting

and gain more time for what matters: your clients.

Time saving

Time saving

Time saving

Time saving

360° investment reporting across all asset classes of the client with just a few clicks.

360° investment reporting across all asset classes of the client with just a few clicks.

Security

Security

Security

Security

Automated creation and dispatch of MiFID II reports.

Automated creation and dispatch of MiFID II reports.

Transparency

Transparency

Transparency

Transparency

Real-time portfolio analysis and financial overview for advisors & clients.

Real-time portfolio analysis and financial overview for advisors & clients.

Flexibility

Flexibility

Flexibility

Flexibility

Simple connection to technical portfolio infrastructure via APIs.

Simple connection to technical portfolio infrastructure via APIs.

Simple connection to technical portfolio infrastructure via APIs.

Extensive reporting analyses

Extensive reporting analyses

Extensive reporting analyses

Extensive reporting analyses

More data, more depth, more clarity – the most popular features of our investment reporting software.

More data, more depth, more clarity – the most popular features of our investment reporting software.

More data, more depth, more clarity – the most popular features of our investment reporting software.

Analysis and Benchmark Reporting

Advisors and clients gain deep insights into portfolio performance over various periods. The software allows for direct comparison with specific benchmarks and provides detailed analyses by categories and instruments, as well as metrics such as loss deviation, Sharpe ratio, Sortino ratio, and much more.

Breakdowns

Risk analysis

Simulations

Sustainability

Reporting

Analysis and Benchmark Reporting

Advisors and clients gain deep insights into portfolio performance over various periods. The software allows for direct comparison with specific benchmarks and provides detailed analyses by categories and instruments, as well as metrics such as loss deviation, Sharpe ratio, Sortino ratio, and much more.

Breakdowns

Risk analysis

Simulations

Sustainability

Reporting

Analysis and Benchmark Reporting

Advisors and clients gain deep insights into portfolio performance over various periods. The software allows for direct comparison with specific benchmarks and provides detailed analyses by categories and instruments, as well as metrics such as loss deviation, Sharpe ratio, Sortino ratio, and much more.

Breakdowns

Risk analysis

Simulations

Sustainability

Reporting

Analysis and Benchmark Reporting

Advisors and clients gain deep insights into portfolio performance over various periods. The software allows for direct comparison with specific benchmarks and provides detailed analyses by categories and instruments, as well as metrics such as loss deviation, Sharpe ratio, Sortino ratio, and much more.

Breakdowns

Risk analysis

Simulations

Sustainability

Reporting

Analysis and Benchmark Reporting

Advisors and clients gain deep insights into portfolio performance over various periods. The software allows for direct comparison with specific benchmarks and provides detailed analyses by categories and instruments, as well as metrics such as loss deviation, Sharpe ratio, Sortino ratio, and much more.

Breakdowns

Risk analysis

Simulations

Sustainability

Reporting

What our customers say

Lars Busch

Head of Client

Applications & Tools

Private & Corporate Banking

Hauck Aufhäuser Lampe

With CIOS, we connect previously isolated applications and processes. It is simple and attractive, not overloaded. More Apple than Photoshop.

Hauke Ole Hansen

Head of Business Development

& Direct Sales

Berenberg Privatbank

We have digitised our SAA process with Fincite. The consultants can now adjust portfolios during client meetings!

Roman Schwarze

Board of BCA AG |

Managing Director of BCA Maklerrente and asuro GmbH

BCA

With CIOS, our advisors use modern reporting and individual portfolio construction directly in client discussions.

Nick Joren

Product Owner Digital Investments

ABN AMRO Private Banking

Alfred is the result of the close collaboration between Fincite and ABN Amro. Through efficiency, quality, and expertise, Alfred provides our consultants with the tools to meet the needs of our high-end clients.

What our customers say

Lars Busch

Head of Client

Applications & Tools

Private & Corporate Banking

Hauck Aufhäuser Lampe

With CIOS, we connect previously isolated applications and processes. It is simple and attractive, not overloaded. More Apple than Photoshop.

Hauke Ole Hansen

Head of Business Development

& Direct Sales

Berenberg Privatbank

We have digitised our SAA process with Fincite. The consultants can now adjust portfolios during client meetings!

Roman Schwarze

Board of BCA AG |

Managing Director of BCA Maklerrente and asuro GmbH

BCA

With CIOS, our advisors use modern reporting and individual portfolio construction directly in client discussions.

Nick Joren

Product Owner Digital Investments

ABN AMRO Private Banking

Alfred is the result of the close collaboration between Fincite and ABN Amro. Through efficiency, quality, and expertise, Alfred provides our consultants with the tools to meet the needs of our high-end clients.

What our customers say

Lars Busch

Head of Client

Applications & Tools

Private & Corporate Banking

Hauck Aufhäuser Lampe

With CIOS, we connect previously isolated applications and processes. It is simple and attractive, not overloaded.

More Apple than Photoshop.

Hauke Ole Hansen

Head of Business

Development & Direct Sales

Berenberg Private Bank

We have digitised our SAA process with Fincite. The advisors can now adjust portfolios during client discussions!

Roman Schwarze

Board of BCA AG |

Managing Director of BCA

Brokerage Pension and asuro GmbH

BCA

With CIOS, our advisors utilize modern reporting and individual portfolio construction directly in client conversations.

Nick Joren

Product Owner Digital

Investments

ABN Amro Name

Alfred is the result of the close collaboration between Fincite

and ABN Amro. Through efficiency, quality, and expertise, Alfred provides our advisors with the tool ...

Our clients about us

Lars Busch

Head of Client

Applications & Tools

Private & Corporate Banking

Hauck Aufhäuser Lampe

With CIOS, we connect previously isolated applications and processes. It is simple and attractive, not overloaded.

More Apple than Photoshop.

Hauke Ole Hansen

Head of Business

Development & Direct Sales

Berenberg Private Bank

We have digitised our SAA process with Fincite. The advisors can now adjust portfolios during client discussions!

Roman Schwarze

Board of BCA AG |

Managing Director of BCA

Brokerage Pension and asuro GmbH

BCA

With CIOS, our advisors utilize modern reporting and individual portfolio construction directly in client conversations.

Nick Joren

Product Owner Digital

Investments

ABN Amro Name

Alfred is the result of the close collaboration between Fincite

and ABN Amro. Through efficiency, quality, and expertise, Alfred provides our advisors with the tool ...

What our customers say

Lars Busch

Head of Client

Applications & Tools

Private & Corporate Banking

Hauck Aufhäuser Lampe

With CIOS, we connect previously isolated applications and processes. It is simple and attractive, not overloaded.

More Apple than Photoshop.

Hauke Ole Hansen

Head of Business

Development & Direct Sales

Berenberg Private Bank

We have digitised our SAA process with Fincite. The advisors can now adjust portfolios during client discussions!

Roman Schwarze

Board of BCA AG |

Managing Director of BCA

Brokerage Pension and asuro GmbH

BCA

With CIOS, our advisors utilize modern reporting and individual portfolio construction directly in client conversations.

Nick Joren

Product Owner Digital

Investments

ABN Amro Name

Alfred is the result of the close collaboration between Fincite

and ABN Amro. Through efficiency, quality, and expertise, Alfred provides our advisors with the tool ...

Start your project with us!

Talk to our Wealth-Tech experts!

Start your project with us!

Talk to our Wealth-Tech experts!

Start your project with us!

Talk to our Wealth-Tech experts!

Start your project with us!

Talk to our Wealth-Tech experts!

Start your project with us!

Talk to our Wealth-Tech experts!

Wealth management/

Financial planning

Modular wealth

management software

Features fincite • cios

Wealth management/

Financial planning

Modular wealth

management software

Features fincite • cios

Wealth management/

Financial planning

Modular wealth

management software

Features fincite • cios

Wealth management/

Financial planning

Modular wealth

management software

Features fincite • cios

© 2024 Fincite GmbH. All rights reserved.

Wealth Management / Financial Planning

Modular wealth

management software

Features fincite • cios