Ralf Heim wins Entrepreneur of the Year 2025

Lejla Selimovic

27 Nov 2025

Ralf Heim wins Entrepreneur of the Year: An interview about entrepreneurship, AI and the future of wealth management.

On November 18th, our founder and Co-CEO, Ralf Heim, received the Entrepreneur of the Year 2025 award by Bitkom and Payment & Banking at DigiFin 2025. It was a milestone not only for him but for everyone at fincite.

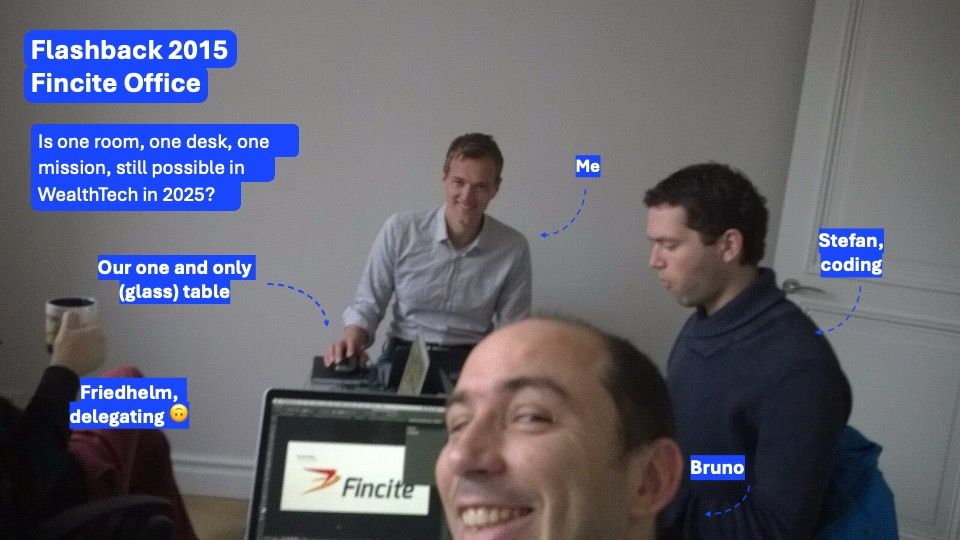

With the award still fresh, we sat down with Ralf to discuss the early days of fincite, the meaning of long-term entrepreneurship, the responsibilities founders hold in an AI driven financial landscape, and the insights he has gained after more than a decade of building one of Europe’s leading WealthTech companies.

Interview with Ralf Heim, founder and Co-CEO of fincite

Looking back at fincite’s early years, what was the moment when you realized the company had the potential to redefine parts of the wealth management value chain?

Ralf: It is hard to point to a single moment, because from day one we knew the investment experience in Europe was fundamentally broken.

Ten years ago, it was obvious that clients were not getting the digital experience they were used to from Netflix und Co. So, the potential was never the question.

The real challenge was finding true product market fit in a very complex value chain. And that took time, about 4 to 5 years of iterating with banks, learning their workflows, and understanding where software could genuinely remove friction.

Around early 2019, things crystallized. We finally saw a repeatable pattern in how we could redefine reporting, turning it from a static, PDF-driven obligation into a dynamic, data driven experience. That is the moment where it became clear to us that fincite could become a category leader. And from that foundation, everything else, especially digital advice processes, started to fall into place.

What does long term entrepreneurship mean to you, especially after a decade of navigating regulation, partners, banks, and continuous product evolution?

Ralf: Entrepreneurship is a beautiful struggle. Each journey is different and WealthTech is special. The constant shadow of regulation, the slow adoption cycles in banks, the high vendor requirements, all things that take time to build up.

Very early on, we made a conscious decision to be patient. To build with discipline.

This was not easy when we saw competitors raising sometimes close to 100 million euros. But in our view, no amount of venture money can compress achieving regulatory compliance, sufficient product maturity, trust building, and the very long sales cycles. And most VCs do not have the patience to wait through these periods.

So, we focused on the long game: iterate the product, compound capabilities, earn trust. And eventually, grow into the role the market needed from us.

The merger with Harvest Group is the continuation of that philosophy. Banks increasingly want fewer, deeper, more strategic partners. Bringing fincite into a European group was not just a growth move. It was the logical next step for long term builders in a market that rewards resilience, credibility, and persistence.

AI is rapidly changing how people invest and how institutions operate. What responsibility do founders in WealthTech have when shaping this new AI driven landscape?

Ralf: Founders in WealthTech carry a double responsibility: to create real value for clients, and to build companies that can earn the trust of future buyers. Ignoring AI means failing both groups.

We are already seeing entire knowledge industries transform, LegalTech, Software Development, where AI copilots are moving at incredible speed. Wealth management is different: it is multi modal, highly regulated, and every output moves real money.

That makes the responsibility even higher. As founders, we must identify AI use cases that are not just flashy, but genuinely improve decisions, workflows, and client experience.

At fincite, we experiment constantly, from analytics automation to advisory support and portfolio intelligence. But the true responsibility goes beyond building prototypes. It is ensuring that what we build can stand the test of compliance, auditability, and risk frameworks inside banks. Getting AI accepted for field rollout is the real bottleneck and navigating that responsibly is part of our job.

Founders in WealthTech do not just ship features. We shape the guardrails for how AI enters one of the most trust sensitive industries in the world.

After 11 years of building fincite, what is one insight about wealth management that you believe the industry still consistently underestimates?

Ralf: More wealthy people manage their money at neobrokers than banks would like to admit.

If an AI version of Ralf could take over one part of your week, which task would Future Ralf gladly outsource first?

Ralf: ChatGPT-Me already does a lot of stuff for me around research. Rarely a meeting that I do not prepare with a prompt. I would gladly hand over my calendar and all logistics, scheduling, documentation, follow ups. But that seems a way to go.

If your entrepreneurial journey had a title like a Netflix series, what would season 11 be called?

Ralf: The Forge of a European Champion - From Local Sparks to a Continental Fire

The first episode would be named: After 327 Committees, 41 Contact Changes and One Last Coffee with Compliance.

Main character: A founder who just wanted to build and sell software.

Conclusion

Ralf’s reflections make one thing clear: fincite’s journey has always been about persistence, curiosity, and a belief that wealth management can be better. His Entrepreneur of the Year award is a milestone, but just one step in a story that continues to unfold. If you want to follow where that journey goes next, join us on LinkedIn for updates, insights, and a look behind the scenes.