Artificial Intelligence as the Co-Pilot for Wealth Advisors

Christian Paulus / January 23, 2024

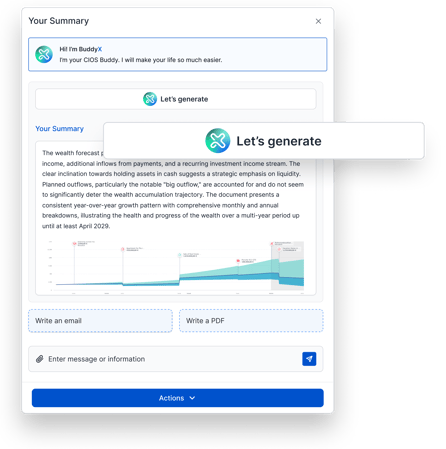

Artificial Intelligence (AI) is set to fundamentally transform the finance sector by supporting human efforts with its potent capabilities and taking over tedious administrative tasks. Amidst this dynamic shift, Fincite has recognized the potential of AI and has integrated the new digital helper "BuddyX" into CIOS. BuddyX serves as a digital assistant, aiding wealth advisors in their daily tasks, enabling them to focus more efficiently on what's essential: the client.

Practical Benefits and Gaining Efficiency

BuddyX is tailored specifically for the needs of wealth management, simplifying the creation of personalized email templates and PDF documents based on personal client conversations. Advisors save time with this AI-driven assistant and can provide clients with detailed summaries of their consultations. What's unique: BuddyX ensures the clarity of all reports. Depending on client needs, various features can be adjusted for robust personalization. For instance, the tone of the summary can be modified to match a client's financial knowledge. Advisors can choose to provide summaries in concise bullet points or, for clients with less financial expertise, as detailed texts with definitions, making it easier for them to understand the content.

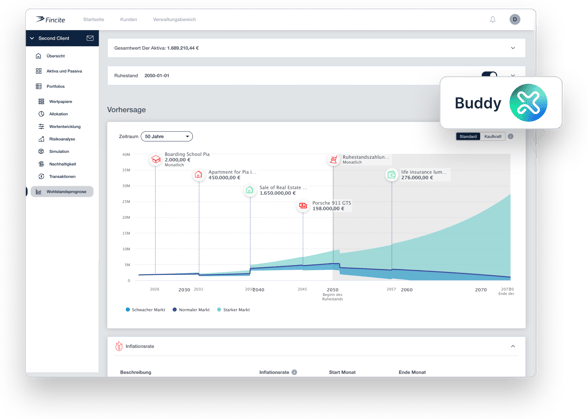

Use Case in Wealth Forecasting

A key feature of Fincite.CIOS is client-centric wealth forecasting. In a detailed initial consultation, the client and advisor discuss major life events such as marriage, property acquisition, or retirement, creating a holistic wealth forecast including in- and outflows along the so-called Lifetime Moments.

After intensive financial planning, which ideally spans a client's entire lifetime, numerous meeting minutes and signatures need to be digitized and made transparently available. With BuddyX, a summary can be automatically generated with just a few clicks.

Data Protection Compliance with EU Hosting

As an integral part of Fincite.CIOS, BuddyX ensures maximum security and transparency, meeting the highest security standards thanks to EU hosting on the Fincite server environment. The underlying technology (LLM) is enriched with all necessary data by Fincite.CIOS. "We are AI-agnostic. Depending on the maturity and requirements of our clients, we can integrate existing open-source solutions or systems hosted by our clients themselves" explains Friedhelm Schmitt, Founder and Co-CEO of Fincite

Seamless Integration

Seamless Integration

Clients and advisors are already accustomed to delegating tedious/time-consuming tasks like text translations or creating presentations to digital helpers. However, the threshold for integrating AI-supported tools into investment consulting seems high. But as demands on advisors increase, so does the call for relief. Automating time-consuming tasks, coupled with ensuring accuracy and compliance, makes BuddyX an invaluable tool for wealth advisors. This new CIOS feature provides time for advisors to focus on individual client needs.

What’s Next?

The solid integration of BuddyX into the CIOS software enables advisors to maximize their time. But this is just the beginning. Future developments will focus not only on reducing time expenditure but also on enhancing the quality of consultation and, consequently, intensifying and improving client relationships – a true catalyst in client care.