- Case Study -

Increasing advisor efficiency with “Alfred” -

the Advisor Software for ABN AMRO

In this case study, our client ABN AMRO shares its experiences about our collaboration and the benefits of our software Fincite.CIOS.

About ABN AMRO

As the 3rd largest bank in the Netherlands, ABN AMRO has its roots in a long history of mergers and acquisitions that date back to 1765.

ABN AMRO has offices in 15 countries with 32,000 employees, most of whom are based in the Netherlands and 5,000 in other countries.

Its operations include a private banking division which focuses on high-net-worth clients in 14 countries as well as commercial and merchant banking operations that play a major role in energy, commodities, and transportation markets as well as brokerage, clearing, and custody.

ABN offers its retail, private and corporate banking clients a full range of financial services and advice.

By combining banking expertise with up-to-date knowledge of their clients’ industries, the economy and the latest digital trends, they craft creative solutions that suit their business needs.

Our Application: Alfred interactive advisor software for increasing efficiency & client satisfaction

In times when costs per advisor increase and revenues on AuM decrease day by day, digitizing the advice process is a key challenge for most institutions.

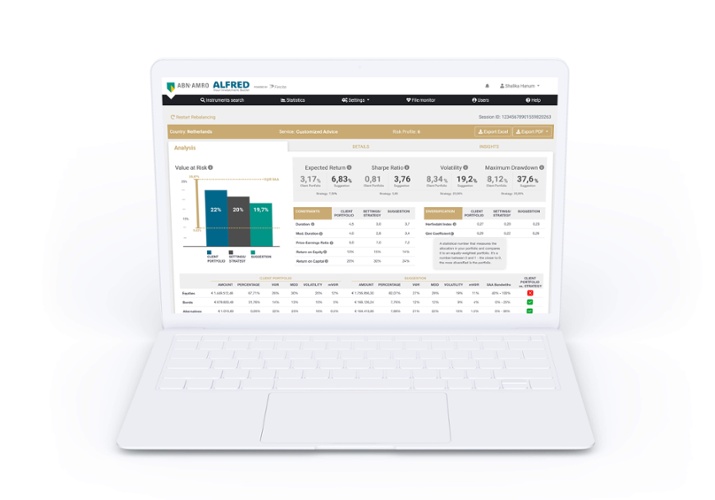

Together with our client ABN AMRO, we have created “Alfred”, an advisory software that optimizes ABN AMRO´s investment process. With Alfred, advisors are able to restructure their clients’ portfolios in line with banks’ investment strategies as well as individual client restrictions.

For example, the software takes into account buy or sell recommendations originated by ABN AMRO’s research and the client’s individual preference towards a certain ISIN.

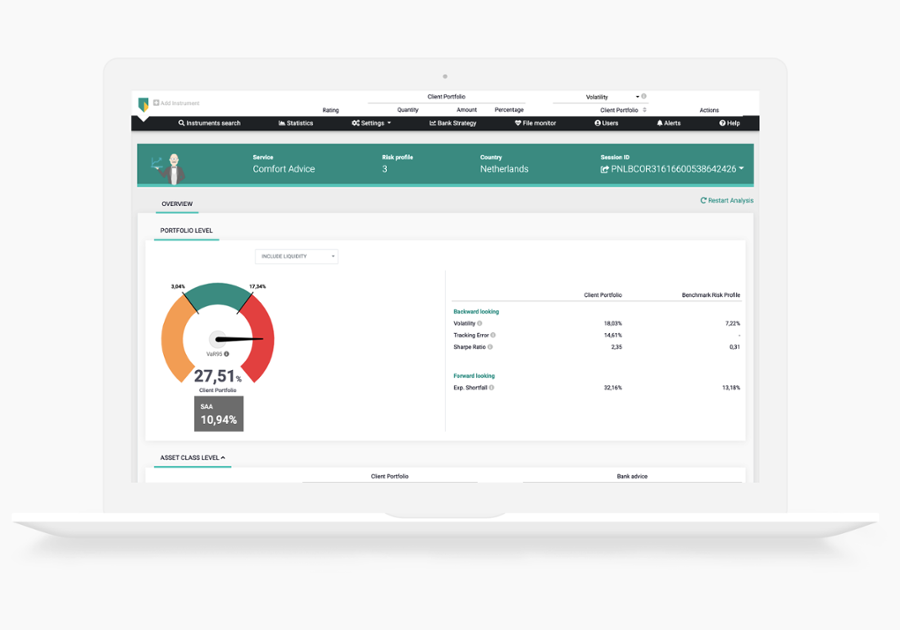

Within only a few seconds, the portfolio is then being rebalanced automatically, complying with all pre-selected investment restrictions. Advisors are also able to retrieve instant risk and performance metrics on multiple levels based on end-of-day pricing. This enables advisors to take control of their risk information and cut dependencies on other bank departments.

Alfred is fully compliant with regulatory requirements, starting with the consideration of the client risk profile and subsequent documentation of the advisory process.

The software is currently being used interactively by around 80 advisors in their daily business together with clients in The Netherlands.

Alfred at a glance

Alfred is a central application for optimizing portfolios in line with all kinds of client restrictions following the Tactical and Strategic Asset Allocations, as well as investment rules of the bank while providing instant risk data.

- Automated rebalancing and optimization of the portfolio

- Reduction of the effort per advisor from 4 hours to 30 minutes

- Increasing compliance by eliminating nearly all investment restriction violations

- Automated capturing of advisor recommendations for client documentation

- Multi-level portfolio risk data within seconds

Process flow of our Advisor Software

- Defining the condition framework

Set bank rules, target allocations, risk profiles, and choose the investment strategy - Manage and rebalance

Rebalance portfolios taking all client constraints and bank investment rules into account - Fast and efficient

Cut portfolio rebalancing efforts down to less than 1 second or do a portfolio risk analysis instantly

Benefits of our Advisor Software

- Allowing clients to individualize their own portfolio

Consideration of client-specific restrictions such as: asset class, region or industry - Fast and efficient

Portfolio construction, rebalancing and transaction generator under 1 second, retrieve risk information on demand - Central management of all investment policies

General bank rules can be managed centrally for all clients, bandwidths for (sub-) asset allocations, risk limits for each type of service in one mask

Facts & Figures of our cooperation

Services

Portfolio Rebalancing, Optimization and Risk AnalysisPartner

ABN AMRO, SIX Financial InformationTarget Group

Financial AdvisorsCalculation & Rebalancing

Rebalancing towards client constraint Rebalancing towards bank TAA and SAARisk analysis

Performance Indicators and Risk Metrics Asset Information (both CIOS.Analyse) –> Portfolio, Class, Subclass and Instrument LevelYour WealthTech Experts

Our Promise:

Get the Case Study directly into your email box.

Discuss your digitization project with our experts. Whether it's customer onboarding, digital or hybrid consultation, ESG or investment reporting.

Personal demo on request.

.png?width=972&height=486&name=Awards%20Website%20(1).png)