Financial Products Governance made easy & compliant! This is what you need to know!

Julian Lee / August 7, 2023

Product governance is intrinsically linked with the MiFID II regulatory framework which came into being after the global financial crash in 2008. MiFID II was designed to enhance investor protection and regulate financial markets and crucially, rebuild investor trust again with Banks and investment companies offering financial products and services.

How can financial products be governed exactly?

The primary objective of product governance is to protect investors As many investment products are sometimes very complex by nature, ETFs and Mutual Funds for example, it’s not immediately clear how the governance is structured. Let’s use these two types of investment products to give you concise insight.

ETFs and mutual funds governance pivot around several key elements that together form the backbone of product governance:

1) Target Market Identification

Here, manufacturers delineate the clients' needs and characteristics, compatible with the product (positive target market), and those incompatible (negative target market). This analysis essentially encapsulates the client category, knowledge, experience, financial situation, risk tolerance, as well as objectives and needs that a product caters to. Other key considerations, such as if a financial product should not be made available to only professional investors or whether it should include retail clients at the same time.

2) Risk Management

Making good returns on investment over time is what all investors at the end of the day aim for. Managing Risk though, as any institutional Trader or Portfolio Manager will tell you is just as important. Implementing robust risk management within a portfolio of assets helps identify and alleviate the risks associated with funds. These practices keep a keen eye on various aspects, including investment strategies and risk levels, that might impact the fund's performance and eventual outcomes for investors.

3) Disclosure and Reporting

The role of clear disclosures and regular reporting cannot be understated when it comes to informing investors about a Fund's characteristics, investment strategy, risks, costs, and performance.

4) Due Diligence

Certain groups of investors, such as foundations, churches, pension funds, and regional authorities for instance, must observe special regulations under public law, in the context of their investments.

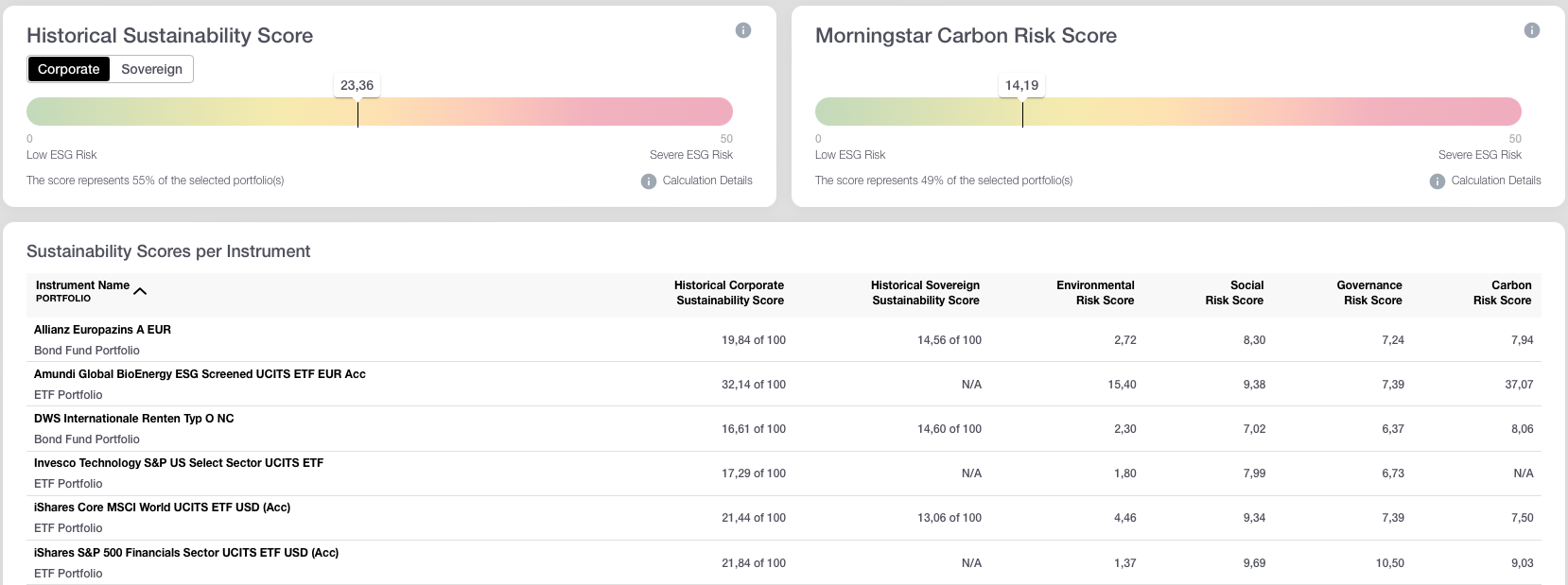

5) Sustainability: A Core Focus with ESG Risk Scoring

The drive for sustainable investment products has never been stronger. Although ESG is still evolving in determining what’s sustainable and what’s not, a comprehensive ESG risk indicator for any analysis to ensure investments align with sustainability objectives is a major benefit. We have published a downloadable Whitepaper on our ESG approach here

Conclusion:

Conclusion:

A modern state-of-the-art software can guide investors and financial advisors through the product governance landscape by facilitating informed decisions and aligning investments, risks, analysis, reporting, sustainability with investment goals.

The usual time-consuming and cost-intensive process of manually reviewing investment products in the context of each individual investor's decision is significantly accelerated and simplified through our modular software solutions built to tackle and streamline these processes.

Compliance with MiFID forms a cornerstone of our software solutions at Fincite. All our platforms adhere to MiFID standards. We built a Fund Governance Platform specifically for Foundations and Endowments in Germany for TiiB (The Institutional Investors Board).

To learn more about how we can help your organization create a comprehensive product governance platform for fund overview and reporting, we invite you to contact us for a demo session or further discussion. Our team is committed to supporting your financial governance needs.

%201.png?width=1342&height=586&name=Target%20Market%20(Profiling)%201.png)