Product

Clients

About us

Knowledge Hub

Onboarding

Watch the Onboarding Tutorial

Product

Clients

About us

Knowledge Hub

Onboarding

Watch the Onboarding Tutorial

Product

Clients

About us

Knowledge Hub

Onboarding

Watch the Onboarding Tutorial

These WealthTech trends should be on your radar for in 2024!

These WealthTech trends should be on your radar for in 2024!

How will we invest in the future? Which asset classes offer

the most potential? Which regulatory updates are relevant for the industry in 2024?

The WealthTech Radar 2024 provides you with informed insights into the

major future topics of our industry - clearly and understandably analyzed by 24 experts.

How will we invest in the future? Which asset classes offer the most potential? Which regulatory updates are relevant for the industry in 2024?

The WealthTech Radar 2024 provides

you with informed insights into the major future topics of our industry - clearly and understandably analyzed by 24 experts.

3 Reasons to Read the Radar

In the WealthTech Radar 2024, we analysed 22 pioneering trends with 23 experts to provide you with informed insights and an advantage in the Wealth Management world.

In the WealthTech Radar 2024, we have analysed 22 groundbreaking trends with 23 experts to provide you with well-founded insights and a head start in the wealth management world.

9 new innovative trends

Together with our experts, we have analysed 9 new trends to keep you one step ahead.

96 pages of innovation

Detailed insights into key areas of the investment landscape - asset classes, services, and infrastructure.

24 expert opinions

The WealthTech Radar 2024 covers trends from idea to commodity.

3 Reasons to Read the Radar

In the WealthTech Radar 2024, we analysed 22 pioneering trends with 23 experts to provide you with informed insights and an advantage in the Wealth Management world.

9 new innovative trends

Together with our experts, we have analysed 9 new trends to keep you one step ahead.

96 pages of innovation

Detailed insights into key areas of the investment landscape - asset classes, services, and infrastructure.

24 expert opinions

The WealthTech Radar 2024 covers trends from idea to commodity.

24 experts as co-authors

24 experts as co-authors

24 experts as co-authors

24 experts as co-authors

22 Trends

22 Trends

22 Trends

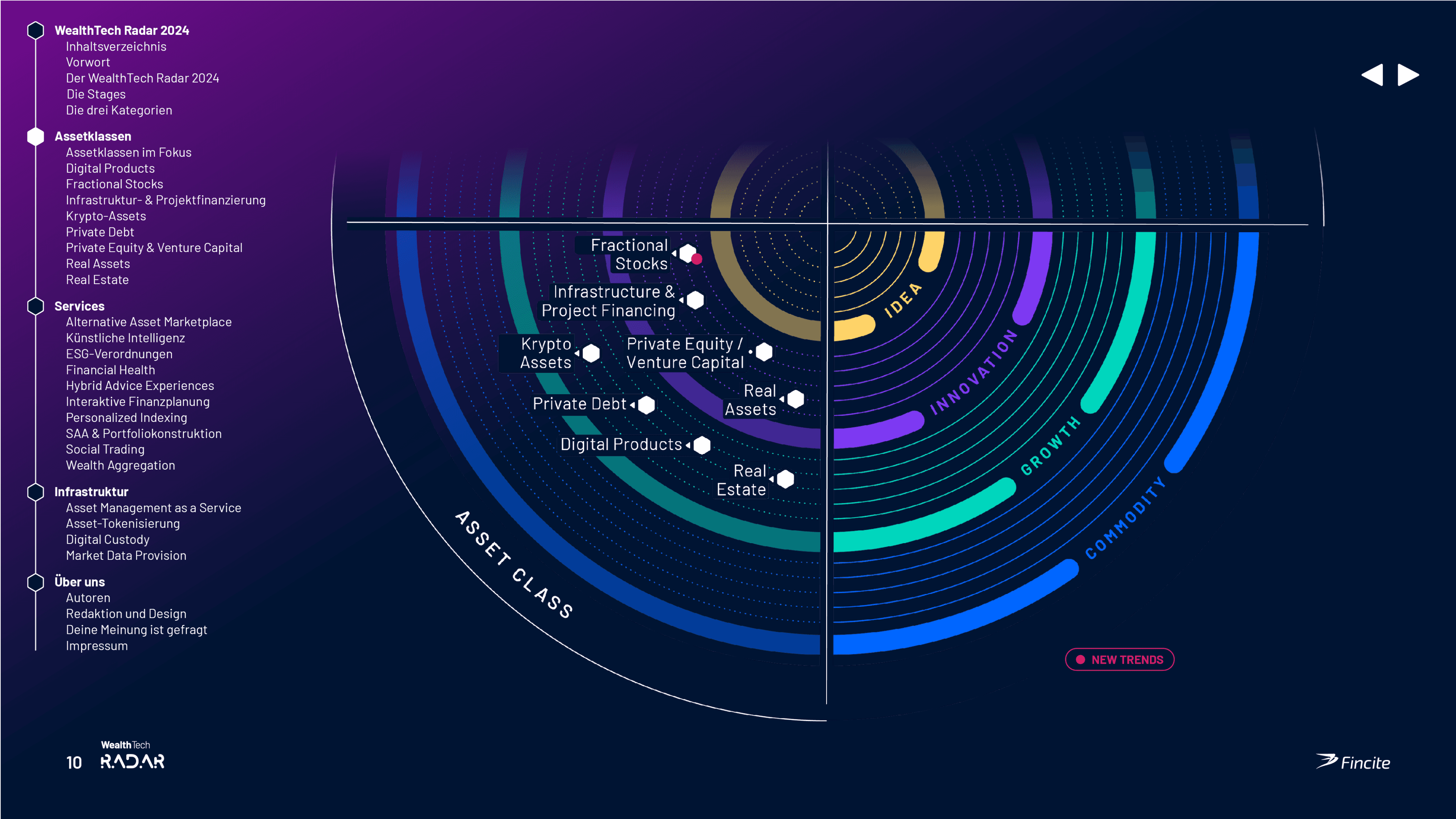

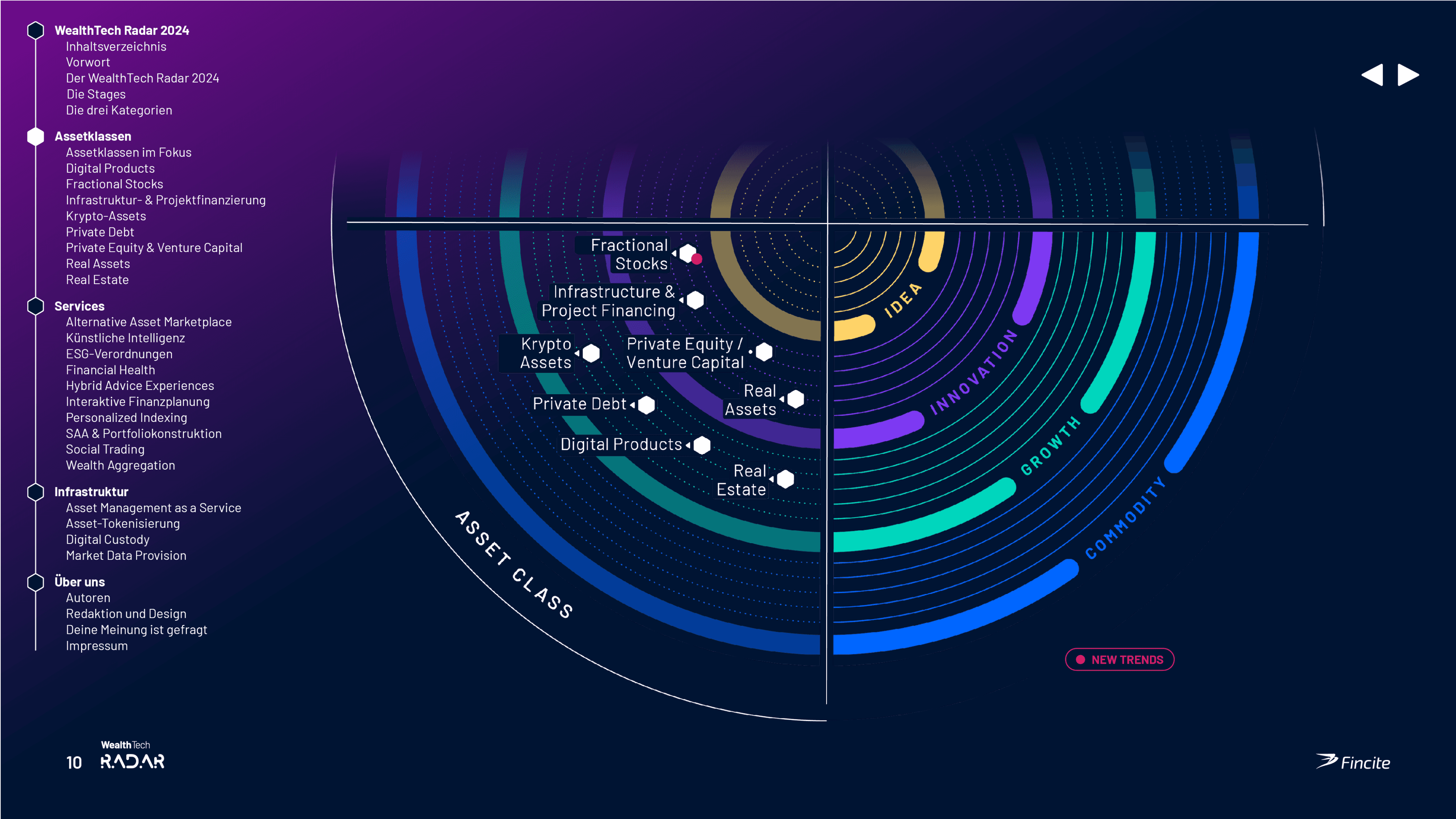

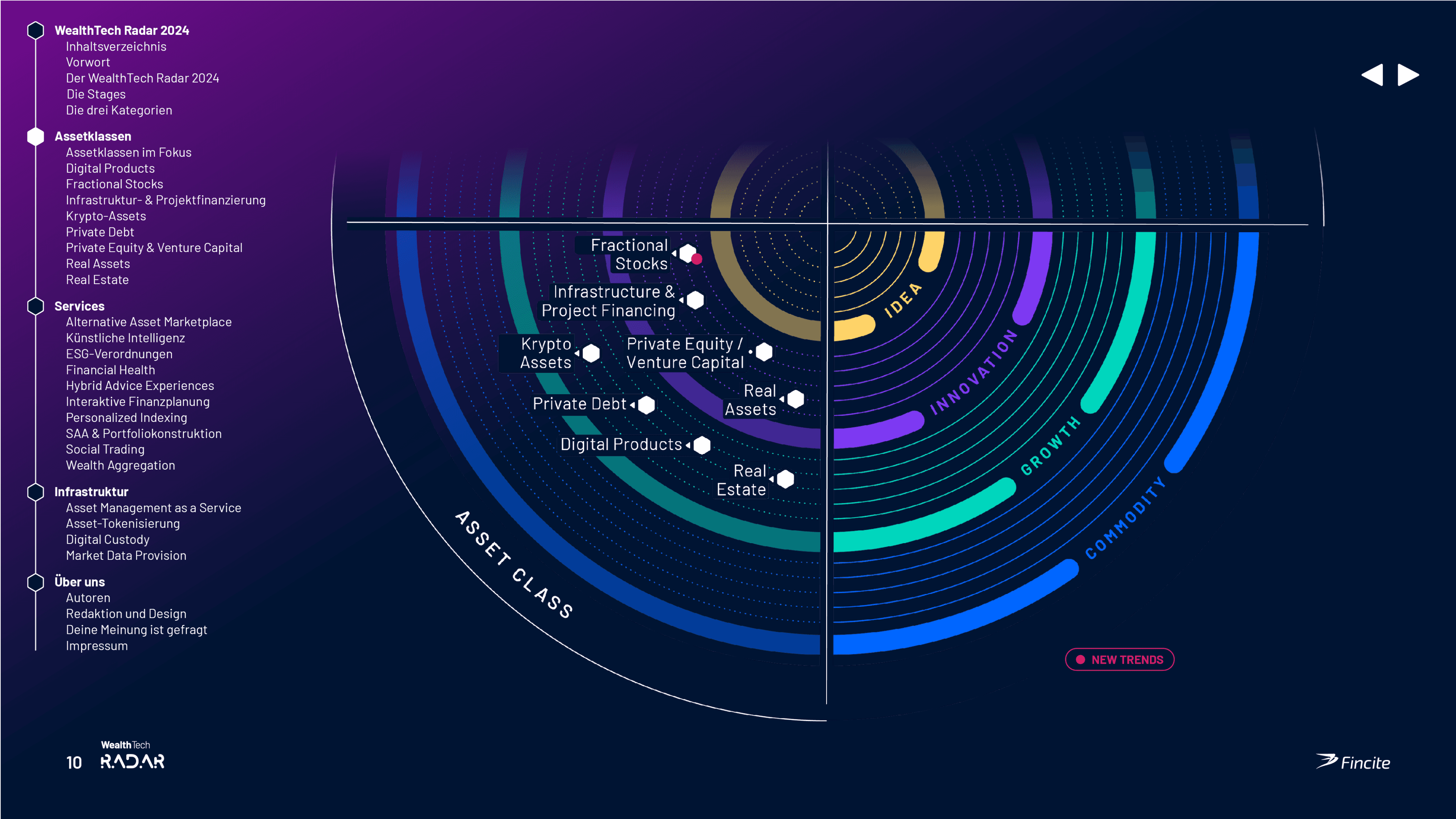

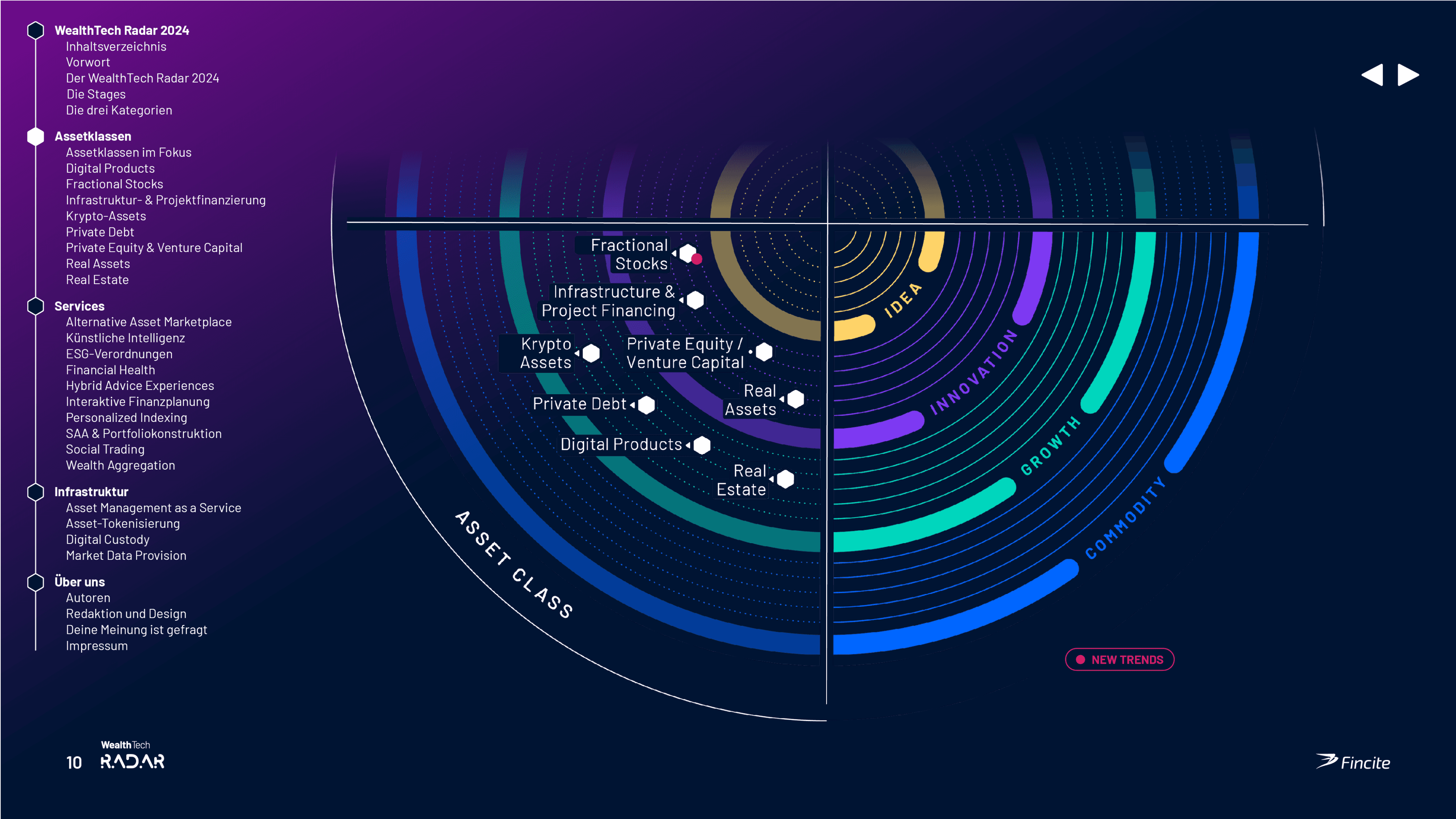

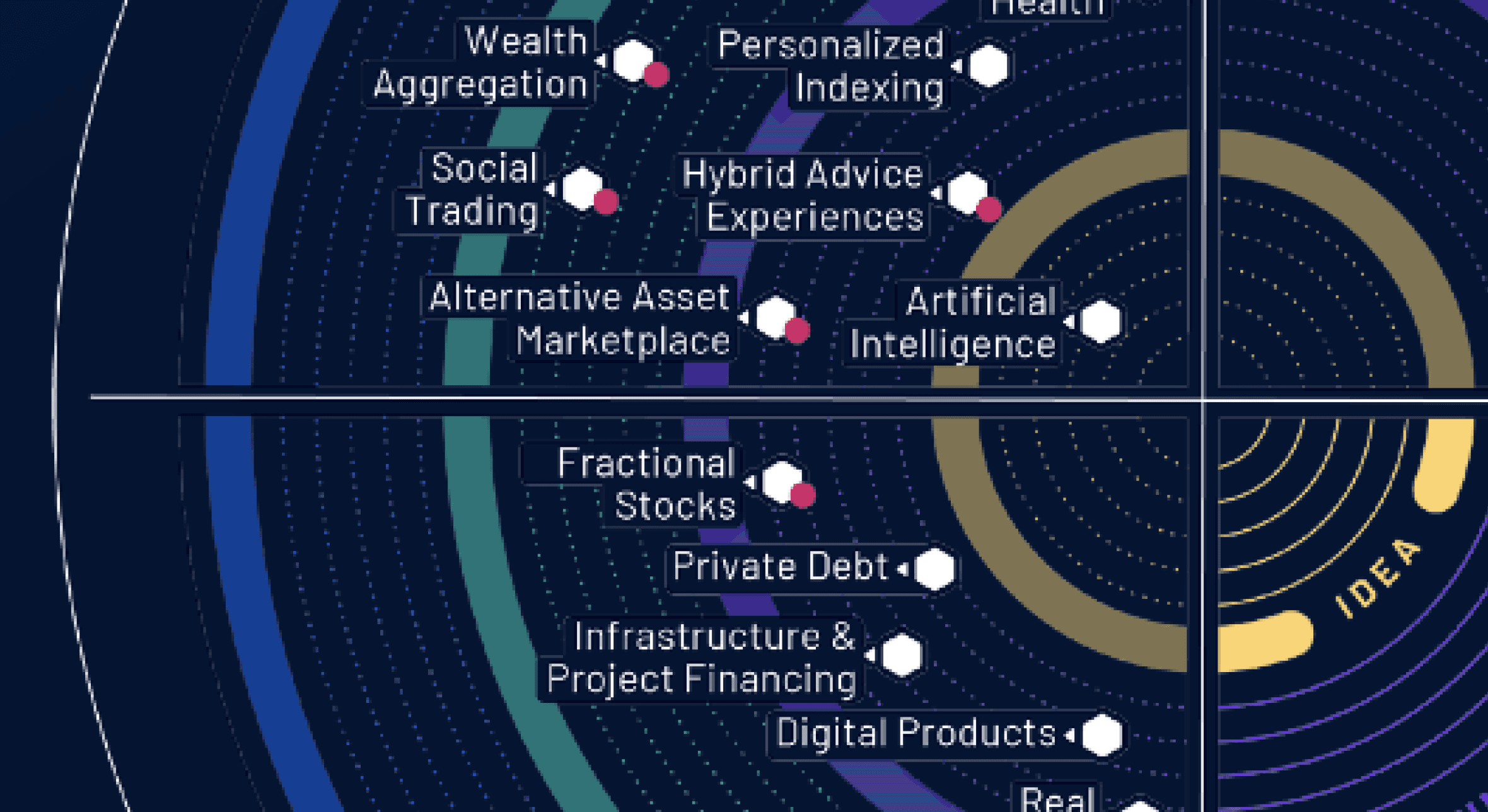

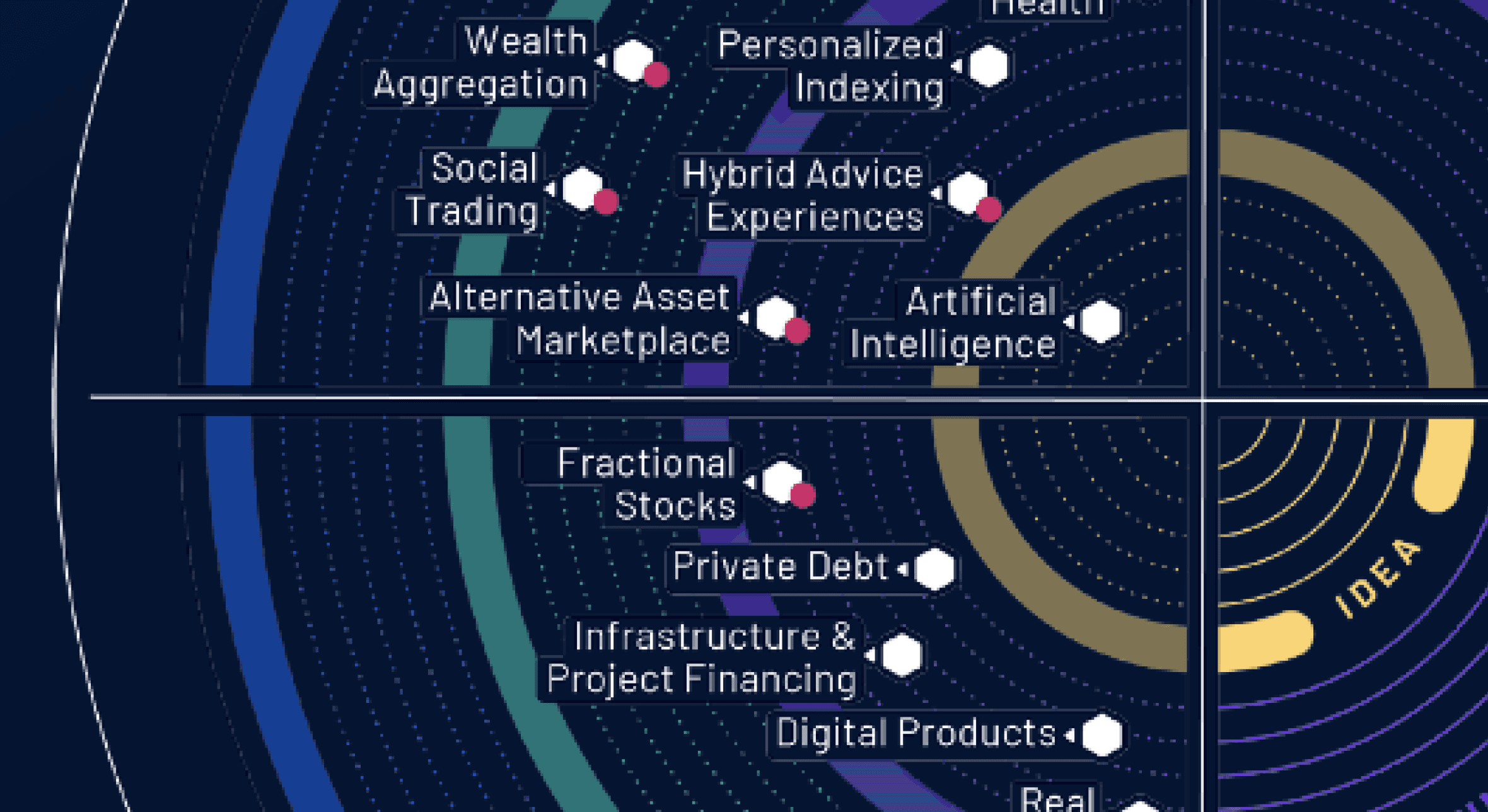

Which products are making their way into the strategic asset allocation in Wealth Management? Which asset classes promise the greatest potential?

The radar provides you with an overview of the 24 most relevant trends in Wealth Management, including: Crypto, Private Equity / Venture Capital, Fractional Stocks, Private Debt, Alternative Asset Market Place, AI, Personalized Indexing, Social Trading, Digital Custody, and more.

Which products find their way into the strategic asset allocation in Wealth Management? Which asset classes promise the greatest potential?

The radar provides you with an overview of

the 24 most relevant trends in Wealth Management, including: Crypto, Private Equity / Venture Capital, Fractional Stocks, Private Debt, Alternative Asset Market Place, AI, Personalized Indexing, Social Trading, Digital Custody, and more.

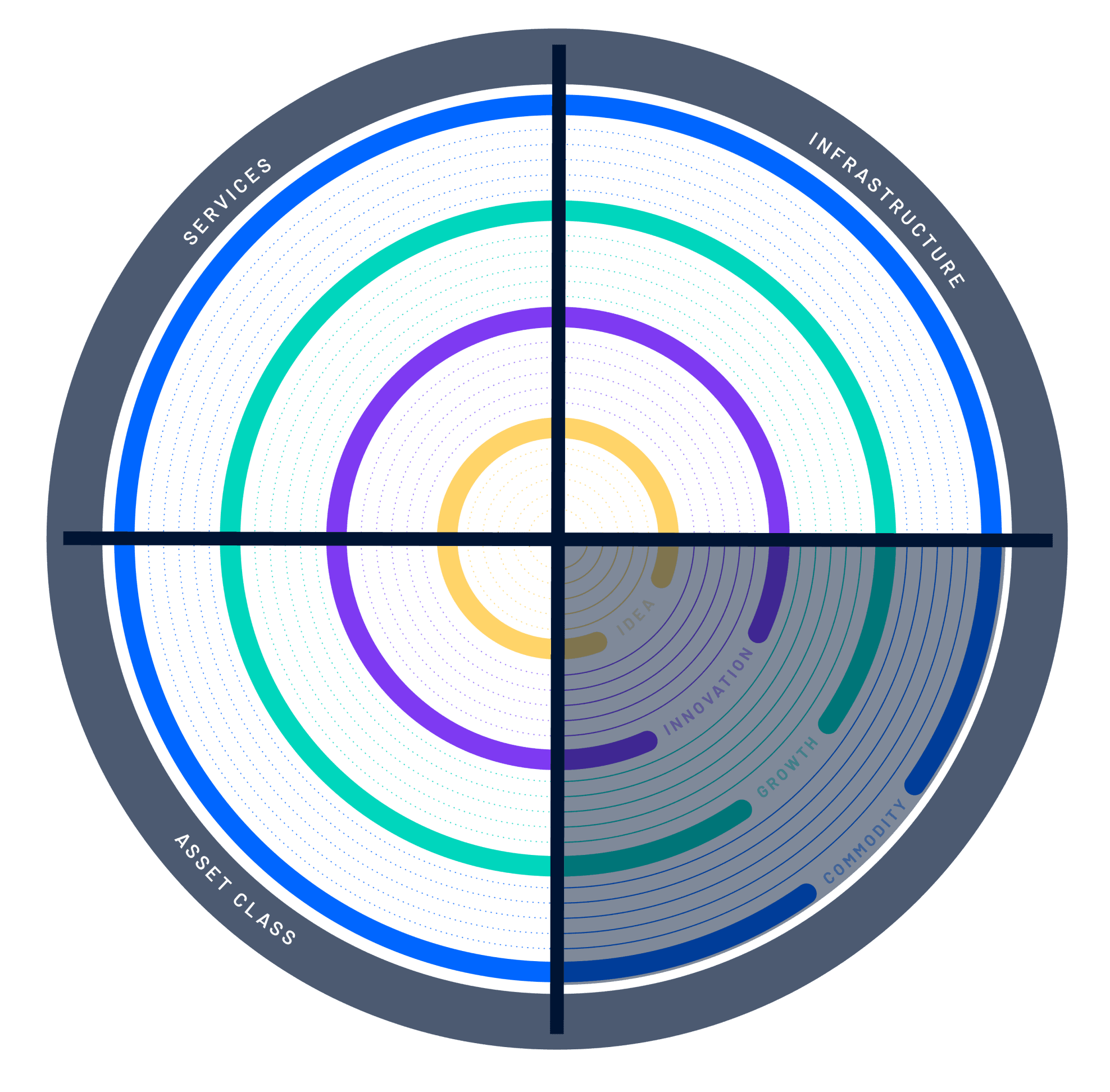

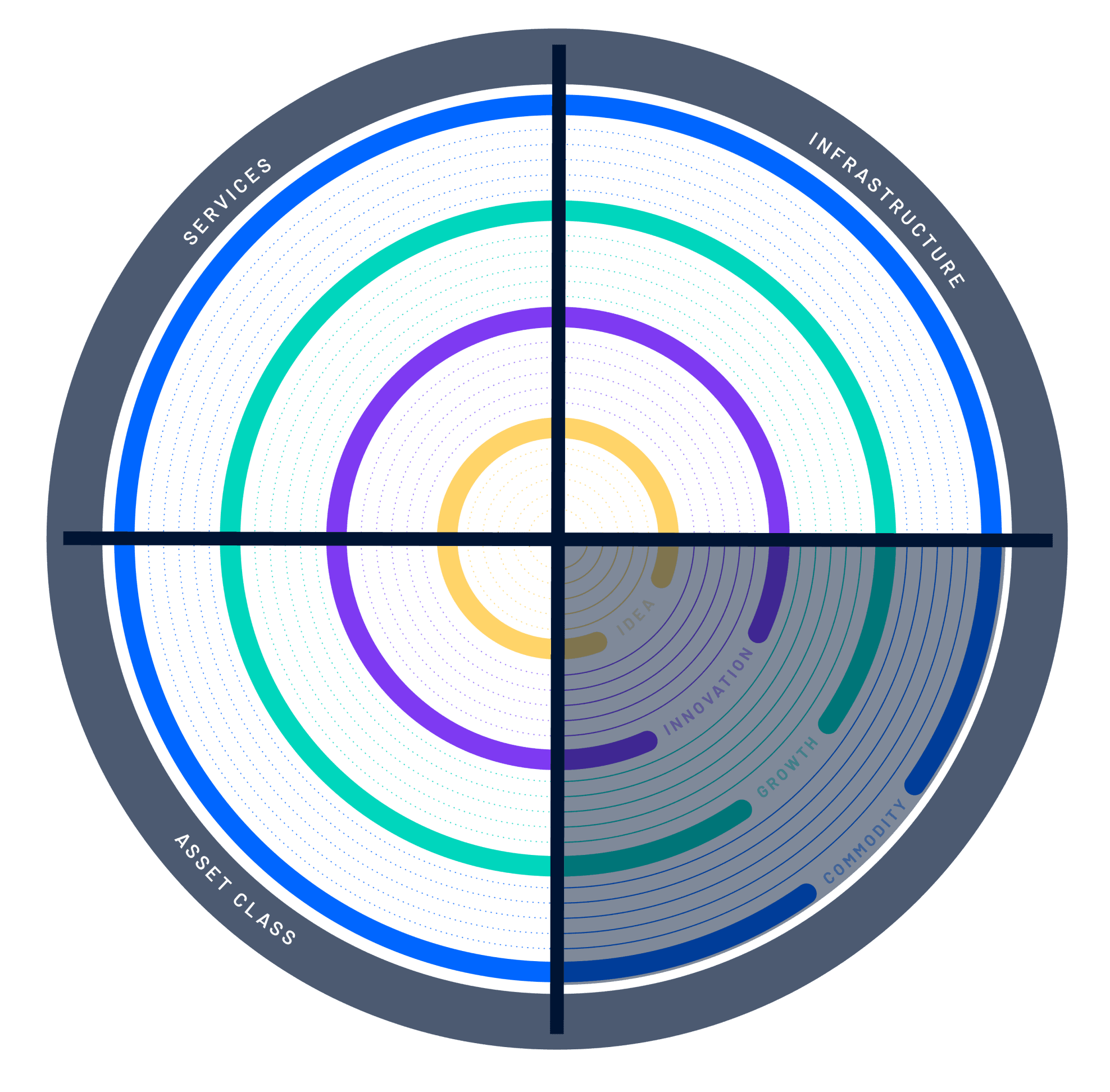

3 categories

3 categories

3 categories

So that you can stay informed about the most important developments at all times, we have divided all trends in the Radar into three major categories:

So that you can stay informed about the most important developments at all times, we have divided all trends in the Radar into three major categories:

1

Asset classes: Digital Products, Crypto Assets, Private Debt, Real Estate, and more.

2

Services: AI, ESG regulations, personalised indexing, SAA & portfolio optimization and much more.

3

Infrastructure: Asset Management as a Service, Asset tokenization and more.

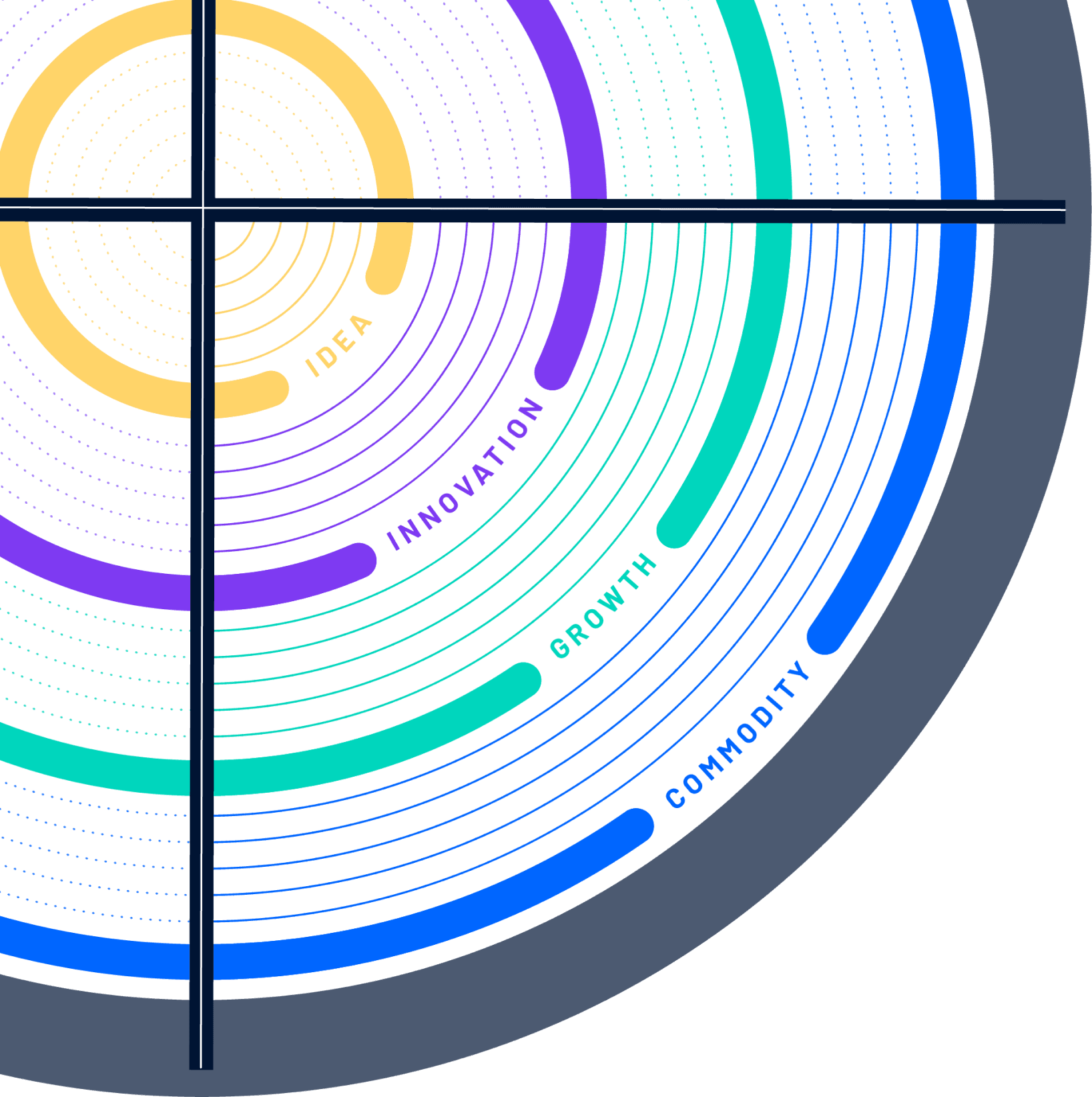

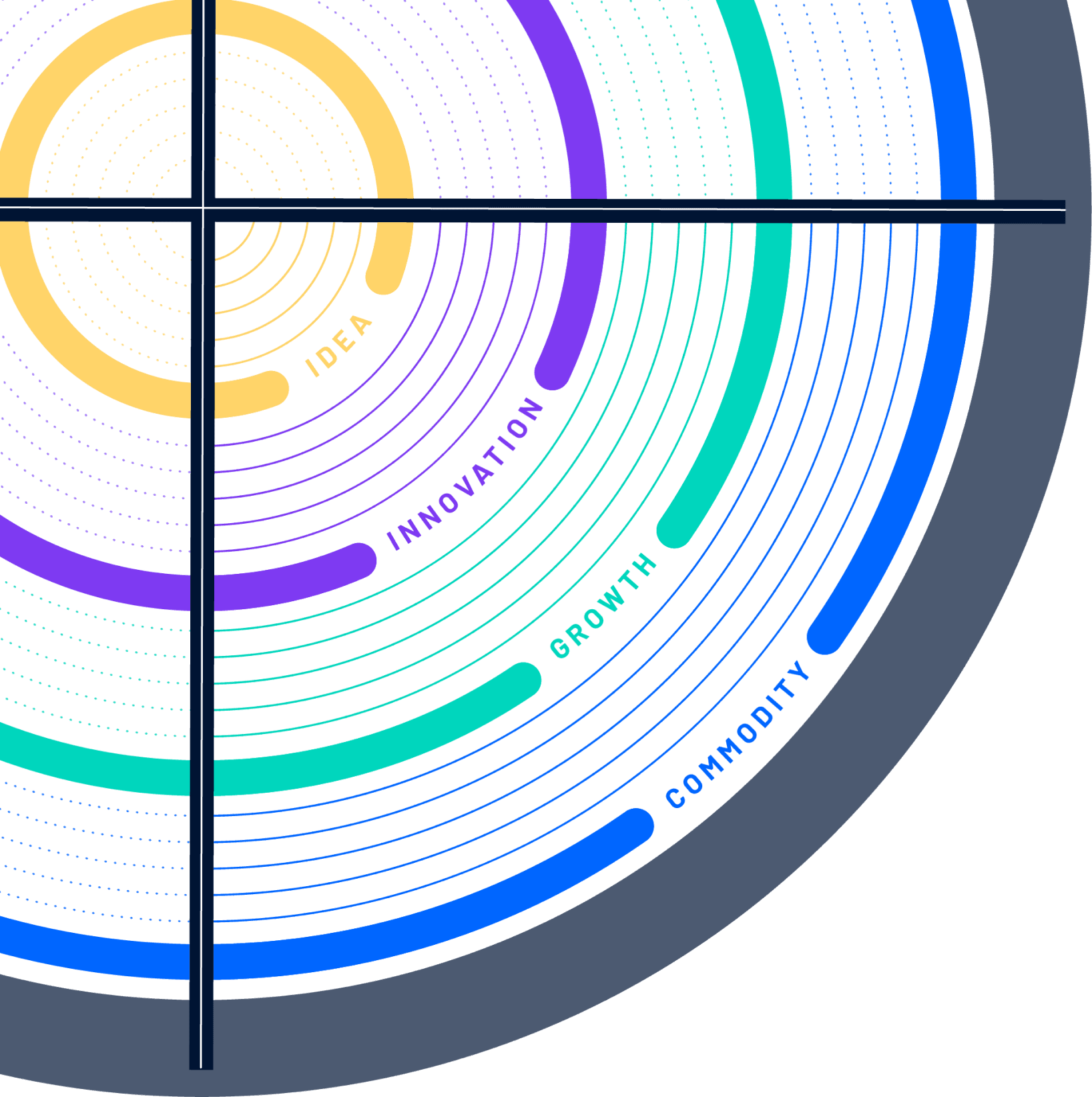

4 Stages of Innovation

4 Stages of Innovation

4 Stages of Innovation

After months of research, the editorial team has analyzed every trend in detail and categorized them into the following four maturity levels with the co-authors:

After months of research, the editorial team has analyzed every trend in detail and categorized them into the following four maturity levels with the co-authors:

1

Idea Stage: Trends are thought experiments or visions.

2

Innovation Stage: the first start-ups or offerings are emerging in the market.

3

Growth Stage: Initial market participants prove themselves and experience strong growth.

3

Commodity Stage: Services that have already established themselves in the mainstream.

Download WealthTech Radar 2024

Download WealthTech Radar 2024

Quotes from our experts

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Simply providing data will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The Key Element in the Growth Market Surrounding Cryptocurrency and Digital Assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will be a driver in 2024

for asset tokenization.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly change the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Humans and Artificial Intelligence (AI) complement each other perfectly to deliver better results in combination. AI will not fully take over our jobs, but it is very likely to assist employees who use AI.

Marco di Sazio

Digital Transformation Manager,

Bankhaus Metzler

The best of both worlds: Hybrid Financial Advice changes the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must report on it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target group to access the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, particularly the sub-segment focused on lending for the growth financing of software and technology companies, will attract investor interest due to their positive risk/return profile and their attractive absolute returns compared to other asset classes such as equities or liquid credit.

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Pure data supply will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The key element in the growth market surrounding cryptocurrencies and digital assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will become a driver for asset tokenization in 2024.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly transform the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Human beings and artificial intelligence (AI) complement each other ideally to deliver better results in combination. AI will not fully take over our jobs; however, it is very likely to assist employees who use AI.

Ulli Marco di Sazio

Digital Transformation Manager,

Metzler Bank

The best of both worlds: Hybrid Financial Advice is changing the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must provide information about it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target audience access to the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, and in particular the sub-segment focused on lending for the growth financing of software and technology companies, will attract the attention of investors due to their positive risk-return profile and their attractive absolute returns compared to other asset classes such as equities or liquid loans.

Quotes from our experts

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Simply providing data will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The Key Element in the Growth Market Surrounding Cryptocurrency and Digital Assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will be a driver in 2024

for asset tokenization.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly change the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Humans and Artificial Intelligence (AI) complement each other perfectly to deliver better results in combination. AI will not fully take over our jobs, but it is very likely to assist employees who use AI.

Marco di Sazio

Digital Transformation Manager,

Bankhaus Metzler

The best of both worlds: Hybrid Financial Advice changes the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must report on it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target group to access the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, particularly the sub-segment focused on lending for the growth financing of software and technology companies, will attract investor interest due to their positive risk/return profile and their attractive absolute returns compared to other asset classes such as equities or liquid credit.

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Pure data supply will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The key element in the growth market surrounding cryptocurrencies and digital assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will become a driver for asset tokenization in 2024.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly transform the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Human beings and artificial intelligence (AI) complement each other ideally to deliver better results in combination. AI will not fully take over our jobs; however, it is very likely to assist employees who use AI.

Ulli Marco di Sazio

Digital Transformation Manager,

Metzler Bank

The best of both worlds: Hybrid Financial Advice is changing the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must provide information about it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target audience access to the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, and in particular the sub-segment focused on lending for the growth financing of software and technology companies, will attract the attention of investors due to their positive risk-return profile and their attractive absolute returns compared to other asset classes such as equities or liquid loans.

Quotes from our experts

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Simply providing data will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The Key Element in the Growth Market Surrounding Cryptocurrency and Digital Assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will be a driver in 2024

for asset tokenization.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly change the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Humans and Artificial Intelligence (AI) complement each other perfectly to deliver better results in combination. AI will not fully take over our jobs, but it is very likely to assist employees who use AI.

Marco di Sazio

Digital Transformation Manager,

Bankhaus Metzler

The best of both worlds: Hybrid Financial Advice changes the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must report on it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target group to access the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, particularly the sub-segment focused on lending for the growth financing of software and technology companies, will attract investor interest due to their positive risk/return profile and their attractive absolute returns compared to other asset classes such as equities or liquid credit.

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Pure data supply will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The key element in the growth market surrounding cryptocurrencies and digital assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will become a driver for asset tokenization in 2024.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly transform the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Human beings and artificial intelligence (AI) complement each other ideally to deliver better results in combination. AI will not fully take over our jobs; however, it is very likely to assist employees who use AI.

Ulli Marco di Sazio

Digital Transformation Manager,

Metzler Bank

The best of both worlds: Hybrid Financial Advice is changing the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must provide information about it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target audience access to the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, and in particular the sub-segment focused on lending for the growth financing of software and technology companies, will attract the attention of investors due to their positive risk-return profile and their attractive absolute returns compared to other asset classes such as equities or liquid loans.

Quotes from our experts

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Simply providing data will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The Key Element in the Growth Market Surrounding Cryptocurrency and Digital Assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will be a driver in 2024

for asset tokenization.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly change the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Humans and Artificial Intelligence (AI) complement each other perfectly to deliver better results in combination. AI will not fully take over our jobs, but it is very likely to assist employees who use AI.

Marco di Sazio

Digital Transformation Manager,

Bankhaus Metzler

The best of both worlds: Hybrid Financial Advice changes the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must report on it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target group to access the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, particularly the sub-segment focused on lending for the growth financing of software and technology companies, will attract investor interest due to their positive risk/return profile and their attractive absolute returns compared to other asset classes such as equities or liquid credit.

Soheil Raja

Founder, Quetta Finance

In a time when the synergy of traditional methods and digital solutions is fundamentally changing wealth management, it is important to understand digital assets as an opportunity to explore previously neglected and emerging markets through innovative and tailored investment strategies.

Alexander Sperlich

Managing Director, Morningstar

For future success, data providers are required to offer solutions that provide added value. Pure data supply will no longer be sufficient.

Ulli Spankowski

CDO/CPO/CHRO, Stuttgart Stock Exchange Digital

Digital Custody - The key element in the growth market surrounding cryptocurrencies and digital assets.

Alireza Siadat

Lawyer & Partner, Annerton

The regulation will become a driver for asset tokenization in 2024.

Francois Botha

Founder & CEO, &Simple

The use of precise, up-to-date, and structured data can significantly transform the entire value chain.

Nico Baum

Head of Business Management

& Development Asset Management

| Head of Innovation & Data, Berenberg

Human beings and artificial intelligence (AI) complement each other ideally to deliver better results in combination. AI will not fully take over our jobs; however, it is very likely to assist employees who use AI.

Ulli Marco di Sazio

Digital Transformation Manager,

Metzler Bank

The best of both worlds: Hybrid Financial Advice is changing the game.

Sonia Zugel

CEO & Founder, ESG Playbook

The CSR directive came into effect in January 2024, and by 2026, 50,000 companies must provide information about it.

Ralf Oetting

Founder & Managing Director, justTRADE

Enabling an attractive, young target audience access to the capital market with fractional stocks.

Olya Klueppel

Partner & Head of Credit, GP Bullhound

Personal loans, and in particular the sub-segment focused on lending for the growth financing of software and technology companies, will attract the attention of investors due to their positive risk-return profile and their attractive absolute returns compared to other asset classes such as equities or liquid loans.

View into the radar (Preview)

View into the radar (Preview)

WealthTech Radar 2024

Download our WealthTech Radar now!

WealthTech Radar 2024

Download our WealthTech Radar now!

WealthTech Radar 2024

Download our WealthTech Radar now!

WealthTech Radar 2024

Download our WealthTech Radar now!

Wealth Management/

Financial Planning

Modular Wealth

Management Software

Features Fincite CIOS

Wealth Management/

Financial Planning

Modular Wealth

Management Software

Features Fincite CIOS

Wealth Management/

Financial Planning

Modular Wealth

Management Software

Features Fincite CIOS

© 2024 Fincite GmbH. All rights reserved.

Wealth Management/

Financial Planning

Modular Wealth

Management Software

Features Fincite CIOS

Wealth Management/

Financial Planning

Modular Wealth

Management Software

Features Fincite CIOS