Innovative UX

Erhöht Ihre Kundenzufriedenheit und sorgt dafür, dass die Nutzung Ihrer Investitionsdienstleistung Spaß macht.

WealthTech Software aus dem Herzen Frankfurts. Lernen Sie uns kennen.

Du willst zusammen mit uns die Welt der digitalen Investments revolutionieren? Hier geht’s lang!

Alle Partner auf einen Blick von Depotbanken bis Software-Partner.

Gemeinsam die WealthTech Szene revolutionieren!

Unsere Softwarelösung für Ihr Kunden-Onboarding. Als Self-Excecution, Advisor-Guided oder Hybrid!

Ob 100 % digital oder hybrid mit persönlicher Beratung, unsere Software passt sich Ihrem Betriebsmodell modular an.

Von der SAA Construction, Advisor Software bis hin zum Portfolio Managment. Unsere Software digitalisiert Ihren Prozess E2E.

Transaction Ordering. Kontaktieren Sie uns für eine persönliche Beratung.

Von der Vermögensaggregation bis hin zur Portfolioanalyse mit CIOS.Reporting erhalten Sie alle Vermögensdaten Ihrer Kunden – aufbereitet in intuitiven Dashboards.

Übersicht ausgewählter Kund:innen: Mit CIOS.Advice können Ihre Berater:innen das gesamte Vermögen Ihrer Kund:innen in einer einzigen Anwendung aggregieren, eine ganzheitliche Finanzplanung entlang wichtiger Lebensereignisse erstellen und verschiedene Anlagestrategien vergleichen.

.png)

Eine ganzheitliche Wealth-Management-Plattform, um Ihre Kund:innen mit einer erstklassigen Benutzererfahrung zu begeistern.

Erhöht Ihre Kundenzufriedenheit und sorgt dafür, dass die Nutzung Ihrer Investitionsdienstleistung Spaß macht.

Aggregation der Vermögenswerte Ihrer Kund:innen mit intelligenten Analysen und Vergleichen.

Intelligenter Portfolio Health-Check mit automatischen SAA-Vorschlägen.

Das digitale MiFID II-Profiling erhöht die Effizienz, Genauigkeit, Personalisierung und Compliance für Berater:innen und Kund:innen. Präzise und einheitliche Informationen über die finanziellen Ziele, die Risikotoleranz und die Anlagepräferenzen der Kund:innen sind ein wesentlicher Vorteil des Beratungsmoduls.

Auf diese Weise ermöglicht CIOS den Berater:innen eine individuellere Kundenberatung und die Anpassung an veränderte Kundenbedürfnisse.

.png)

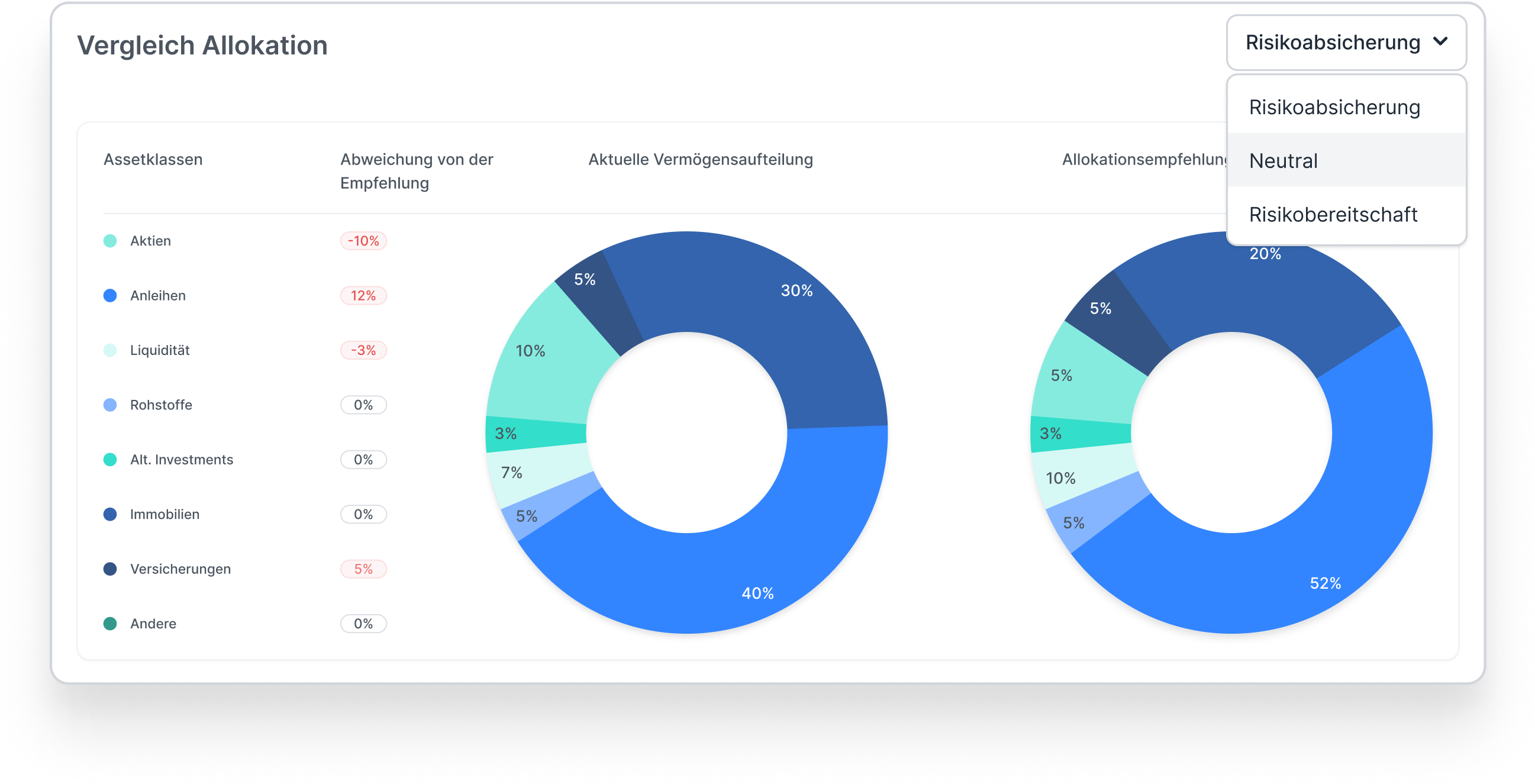

Durch den Vergleich von Soll- und Ist-Werten auf Basis einer ganzheitlichen Vermögensallokation lassen sich Abweichungen des Kundenportfolios von einer gewählten Bankstrategie leicht erkennen.

Die zielorientierte Vermögensplanung stellt die Anlageziele Ihrer Kunden in den Mittelpunkt und beinhaltet eine ganzheitliche Vermögensallokation. Mit der intuitiven Erstellung von Anlagezielen können alle relevanten Werte im Kundengespräch einfach abgerufen werden. Bieten Sie Ihren Kunden das beste Anlageerlebnis und:

.png)

Die Wohlstandsprognose ermöglicht es, das Vermögen des Kunden in verschiedenen Marktszenarien zu planen, indem die erwarteten Marktrenditen den einzelnen Vermögenswerten zugeordnet werden. Darüber hinaus hilft eine Ruhestandsplanung, Lücken in der Vermögensplanung zu identifizieren, unterstützt durch die Schaffung von Liquiditätsereignissen wie dem Kauf eines neuen Autos oder der Ausbildungsfinanzierung der Kinder.

CIOS deckt den gesamten Beratungsprozess von der Strategieauswahl, über den Portfolio- und Strategievergleich bis hin zum Portfolio-Health-Check ab. Darüber hinaus können Finanzinstitute das gesamte Anlageuniversum einbeziehen, alle Daten in einer vergleichbaren Übersicht strukturieren und tiefe Einblicke in alle Produkte geben.

CIOS ermöglicht es Beratern, ihre Anlagevorschläge mit tiefen Analysen über alle Anlageklassen hinweg mit einer einzigen Anwendung zu erklären - und das sogar mit Spaß!

Mit CIOS.Advice ermöglichen Finanzinstitute ihren Beraterteams eine effizientere Zusammenarbeit.

Alle Teammitglieder können ihre OKRs individuell festlegen und verfolgen, Administratoren können Teams definieren und jeder Vermögensberater kann problemlos ein Kundengespräch übernehmen, wenn ein anderer Berater nicht verfügbar ist (z. B. in der Urlaubszeit).

Steigern Sie die Konversionsrate Ihrer Kunden mit einer erstklassigen Benutzererfahrung.

Erhalten Sie einen ganzheitlichen Überblick über alle Assets & Produkte.

Ermöglichen Sie Teamarbeit auf höchstem Niveau!

Verabschieden Sie sich von Excel.

Alfred ist das Ergebnis einer sehr engen und professionellen Zusammenarbeit zwischen Fincite und ABN Amro. Durch die Kombination von Effizienz, Qualität und Expertise in einer Plattform gibt Alfred unseren Beratern das Instrumentarium an die Hand, um alle Bedürfnisse unserer (High-End-)Kunden zu erfüllen.

Mit CIOS nutzen unsere Berater modernes Reporting und individuelle Portfoliokonstruktion direkt im Kundengespräch.

Mit CIOS verbinden wir bisher isolierte Anwendungen und Prozesse. Es ist einfach und attraktiv, nicht überladen. Mehr Apple als Photoshop.

Wir haben unseren SAA-Prozess mit Fincite digitalisiert. Die Berater können Portfolios jetzt während der Kundengespräche anpassen!