CIOS Aggregation Engine

Christian Paulus / 1. November 2019

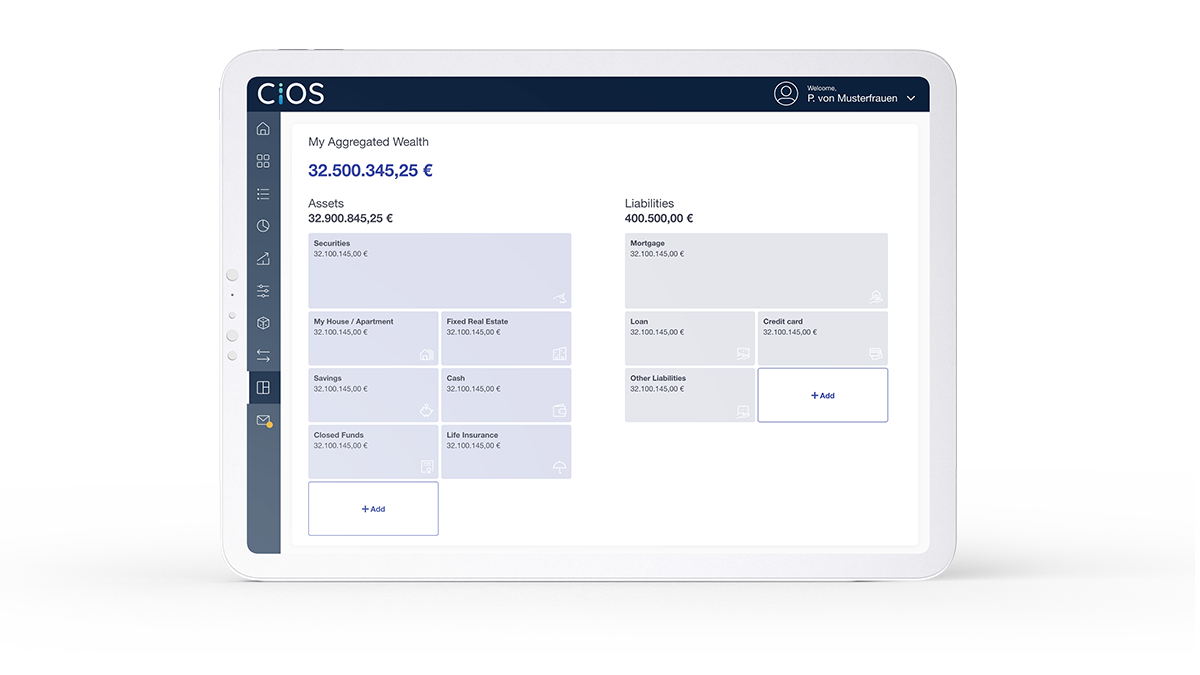

Die Aggregation Engine ist unser Tool für Multi-Banking, PSD II, Finanzaggregation und Open-Banking.

Aggregation ist der Beginn der digitalen Anlageberatung der Zukunft. Während die Finanzaggregation dem Kunden hilft, mit seinen Finanzen auf Kurs zu bleiben, unterstützt sie die Bank bei der Verbesserung der Kundeninteraktion.

Doch die Aggregation birgt auch analytisches Potenzial für eine digitale Investmentreise: Eine 360°-Übersicht kann der Ausgangspunkt für eine Portfolioanalyse oder die Berechnung von Vorsorgelücken sein. Durch die finanzielle Aggregation kann die Bank für jeden ihrer Kunden individuell feststellen, was der bestmögliche nächste Schritt ist.

Erfahren Sie mehr über unsere Aggregation Engine für Multi-Banking.

Vorteile unserer Aggregation Engine für Multi-Banking:

Vollständiger Überblick über alle Vermögenswerte Ihrer Kunden.

Überprüfen Sie die Portfolios Ihrer Kunden bei anderen Banken und identifizieren Sie Optimierungspotenziale.

Generieren Sie neue Vertriebsimpulse.

Eine 360°- Ansicht des Kunden darzustellen, benötigt einen vollständigen Datensatz

Um eine ganzheitliche Übersicht aller Vermögenswerte Ihrer Kunden zur Verfügung zu stellen, bieten wir verschiedene Optionen zur Datenerfassung an.

- Girokonten

Girokonten über Rest-API über unser globales Partnernetzwerk - Depotkonten

Depotkonten über Rest-API über unser globales Partnernetzwerk - Finanzmarkt

Finanzmarktdatenanbieter durch moderne Rest-API - Immobiliendaten

Immobilien durch Abgleich einer manuellen Adresseingabe mit der Evaluation Engine unserer Partner - Private Equity

Private Equity als Richtwert über Informationen mehrerer Marktdatenanbieter - Autos und Kunst

Autos und Kunst durch Rest-API mehrerer Preisdatenbanken - Pensionskonten

Pensionskonten – zum jetzigen Zeitpunkt manuell, via OCR oder als Vollmacht für das Girokonto - Versicherungsdaten

Versicherungsdaten – zum jetzigen Zeitpunkt manuell, via OCR oder als Vollmacht für das Girokonto

Einblicke, die durch eine 360°- Ansicht ermöglicht werden:

- Geldkonten zur Identifizierung der Einnahmen- und Ausgabenstrukturen der Kunden, die Einblicke in Einsparpotenziale und Risikotragfähigkeiten ermöglichen.

- Portfoliokonten zur Analyse der aktuellen Anlagestruktur.

- Marktdaten zur Gewinnung von Erkenntnissen über das Portfolio auf Basis aktueller Finanzmarktdaten.

- Immobilien auf Basis der manuellen Erfassung von Datenpunkten mit automatisierter Auswertung über Immobilienmarktdatenanbieter.

Wir arbeiten u.a. mit folgenden Unternehmen und Partnern zusammen

- Konto-Aggregatoren: figo, Salt Edge, eurobits

- Finanzmarktdaten: Refinitiv, Morningstar, FactSet, Sustainalytics

- Frontend- & Middleware-Partner: Backbase, Five Degrees

- Anbieter von Anlagendaten: Sprengnetter

- Core-Banking & Portfoliomanagement: Sopra Banking, Temenos

"Mit Fincite.CIOS können wir komplexe Portfolios automatisch verwalten. Das verbessert die Effizienz unserer Berater und hilft ihnen, sich auf das Wesentliche zu konzentrieren: unsere Kunden."

Ronald Tuinenga, Product Owner Digital Investments ABN AMRO